I don't think anybody has any idea what the economic impact of Brexit will be. Steve Eisman

Total Pageviews

Monday 31 October 2016

Theme 3: Ten Charts on Oligopoly and Business Economics

Your homework for this evening is to look at one of the charts from the presentation below and comment on how this would affect consumer welfare, and how the firms would compete.....

Slide 2 & 4 - Sam

Slide 3 - Iain

Slide 5 - Salmaan

Slide 6 - Aidan

Slide 7 - Keelan

Slide 8 - Tom

Slide 9 - Lewis

Slide 11 - Erika

Sunday 30 October 2016

Theme 1 & 3: The cost of a cuppa to go up!

Click here to access a BBC article on why the price of a cup of tea is going to go up! Demirhan, why is this happening?

There is lots here that relates to your micro papers. Costs of production, elasticities, weak pound, competition, normal profits.

Excellent article.

There is lots here that relates to your micro papers. Costs of production, elasticities, weak pound, competition, normal profits.

Excellent article.

Thursday 27 October 2016

Theme 3: Vodafone fined for poor service!

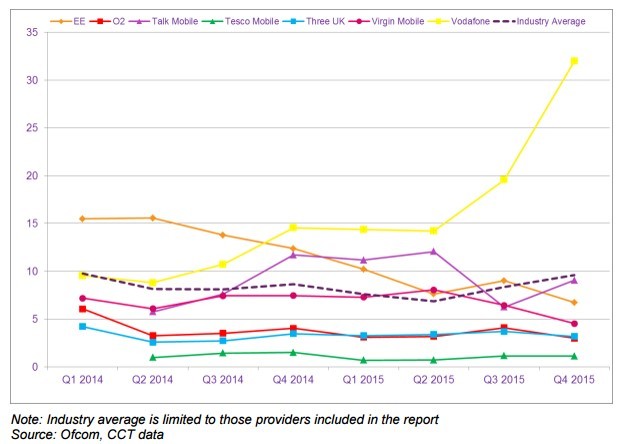

Vodafone have been fined £4.6m by regulator Ofcom for what has been classified as 'serious' breaches of consumer protection rules. These breaches include failing to top up some accounts of Pay As You Go customers and failing to deal adequately with customer complaints. Complaint levels for Q4 of 2015 can be seen below. It does not paint a pretty picture for Vodafone!

This fine offers a different angle for students to consider in terms of the role of regulatory bodies. As well as keeping check on an industry in terms of its prices and scope of delivery, regulators like Ofcom also have a duty to ensure that the quality of service is satisfactory.

The analysis from the Sky News clip below makes a salient point that you students may like to use as an evaluative argument. The clip suggests that a £4.6m fine is a small amount for a firm that makes multi-billion pound profits and may not act as much of a deterrent either to Vodafone or their competitors.

Pay monthly mobile telephony complaints per 100,000 customers/connections: Q1 2014 - Q4 2015:

Wednesday 26 October 2016

Theme 3: Mergers, market power and efficiency

Nice article to read on the impact of takeovers and mergers on economic efficiency and consumer welfare.

Drawing on research on the US economy, a report finds that corporate integration accelerates the process towards oligopolistic markets which can lead to higher prices in the long run.

"Bruce Blonigen and Justin Pierce of the Federal Reserve Board have some evidence. In a new paper titled “Evidence for the Effects of Mergers on Market Power and Efficiency,” they look at how mergers in manufacturing affect corporate performance. What they discovered is that mergers usually tend to increase market power -- in other words, they allow companies to increase profits by hiking prices. But they don’t find much evidence for improved efficiency."

Salmaan, let the class know what you think!

Sunday 23 October 2016

Y12 Economists: Theme 1 - Indirect Taxation & Government Subsidies

Hello all,

just a heads up on this weeks lessons. We only have 3 this week, so I will go though some theory tomorrow (indrect taxes and subsidies), then rest of week, will be spent going through some long answer questions.

just a heads up on this weeks lessons. We only have 3 this week, so I will go though some theory tomorrow (indrect taxes and subsidies), then rest of week, will be spent going through some long answer questions.

All themes: The 6p a minute cafe

I love this idea!

I love this idea!Click here to access a very different business model. This is definitely thinking outside the box. Eamon, can you see any economic theory behind this model?

Theme 4: Ceta talks: EU hopes to unblock Canada trade deal

Click here to access an article about trade blocs, trade deals and the advantages/disadvantages for those involved.

Theme 3: AT & T to buy Time/Warner - integration

Click here to access an article discussing the latest major piece of business integration. For once, I actually find myself siding with Donald Trump!

Useful article when looking at horizontal/conglomerate integration. Specifically the potential advantages/disadvantages of the deal for consumers.

The companies say the deal will bring all sorts of good things for the consumer. However, many (including Trump) are suggesting it would make the company far too powerful.

What do you think...........Aruj?

Useful article when looking at horizontal/conglomerate integration. Specifically the potential advantages/disadvantages of the deal for consumers.

The companies say the deal will bring all sorts of good things for the consumer. However, many (including Trump) are suggesting it would make the company far too powerful.

What do you think...........Aruj?

Thursday 20 October 2016

Theme 1: Elasticity of Supply in action: Where has all the whisky gone?

An almost perfect example here of inelastic supply in action. By law, all Scotch whisky must be aged for a minimum of three years and it takes several years for new distilling capacity to come online.

Questions for Tammy to answer....

Why has the price of whisky gone up? (use a supply & demand diagram in your answer)

What does the article suggest about the elasticity of supply of malt whisky?

Questions for Tammy to answer....

Why has the price of whisky gone up? (use a supply & demand diagram in your answer)

What does the article suggest about the elasticity of supply of malt whisky?

Wednesday 19 October 2016

Theme 3: Netflix and reducing contestability of on line streaming

the video streaming market is one that could be classed as a good example of a highly contestable market. This is on the grounds that the market contains some of the characteristics of contestability such as relatively low sunk costs, low customer loyalty and the market has a highly credible risk of new firms entering.

In recent years, Netflix has become one of the world’s leading providers of video streaming. Concern that their growth was faltering has now reduced as new figures show that the number of new subscribers has increased by 3.2m worldwide between July and September 2016. One key to their growth, however, is the broadened use of their own programmes – many subscribers have shifted across to Netflix to consume their original content (House of Cards, Daredevil & Narcos to name but a few). The cost of such bespoke shows can be considerable and, as such, suggest that it may put off new entrants to the market who are unable to compete with the quality of shows or invest in production of original content when it has little guarantee of success. It could be argued that this level of development in the market is reducing the threat of new-firm entrants and making the market less contestable.

Here is a short news cast outlining recent announcements about Netflix’s success.

Tuesday 18 October 2016

Theme 2: Inflation is beginning to rise - Weak pound to blame

Evening everyone. I'm looking forward to Minsung explaining this article in tomorrows lesson! It is really useful to understand what is going on in the UK economy. This is macro economics, something we which will look at after xmas.

Evening everyone. I'm looking forward to Minsung explaining this article in tomorrows lesson! It is really useful to understand what is going on in the UK economy. This is macro economics, something we which will look at after xmas.However, always good to debate the issues in lessons.

Theme 2, 3 & 4: Will the pound's fall help the UK economy rise?

Larry Elliott's piece here in the Guardian looks at the implications of Brexit, both for the pound in the short-term and the whole economy in the longer term. He reiterates the view that the short-term implications of the weaker currency will change the emphasis within the UK economy.

However, as he points out, its longer term health is largely dependent upon the ability of the UK economy to adapt and adopt the structural reforms required to tackle its twin deficits. If we fail to do this, we've missed a genuine chance to rebalance the economy at a time which might permit seismic change.

Theme 1: Marmite - Love it or hate it?

Morning all,

Morning all,Marmite has been in the news recently, nothing to do with demand and everything to do with supply. Click here to read a 'History' of Marmite.

What does the article suggest about the elasticity of demand doe the product?

Also, regarding recent articles I have posted, what does this suggest about the elasticity of supply of Marmite!

I think todays winner is going to be............Rayshmi!

Sunday 16 October 2016

Theme 3 & 4: The depreciation of the pound and how it affects us all!

Click here to access many recent articles on the collapse of the pound sterling. This is having (and will have) a major impact on the UK economy and hence is extremely likely to be a question on your exam papers next summer!

Click here to access many recent articles on the collapse of the pound sterling. This is having (and will have) a major impact on the UK economy and hence is extremely likely to be a question on your exam papers next summer!We will look at this when we study currency movements after xmas, but please take some time to read some of the various articles. It would be great if you could come to class and discuss what you have read and even ask some questions.

All Themes: UK food prices going up - BREXIT being blamed

See below the article that discusses food price inflation in the UK. This has many links to economics. Supply and demand, elasticity, exchange rates, free trade, inflation to name but a few. I am going to stick a name in this piece, just to see if you are reading this stuff! So, Abi Christon......I'll let you explain the article next lesson!

See below the article that discusses food price inflation in the UK. This has many links to economics. Supply and demand, elasticity, exchange rates, free trade, inflation to name but a few. I am going to stick a name in this piece, just to see if you are reading this stuff! So, Abi Christon......I'll let you explain the article next lesson!Here’s Just How Much More Expensive Food Has Got Since The Brexit Vote

Butter up 58%. Sugar up 37%. Beef up 33%. Pork up 18%. Wheat up 17%. The list goes on…

Britain’s food producers are facing price hikes of more than 50% on some key ingredients since the UK voted to leave the EU, figures obtained by BuzzFeed News reveal.

This week, Unilever, the producer of brands including Marmite, PG Tips, and Lynx, had a public row with Tesco after Unilever sought price hikes of around 10%, blaming higher costs post-Brexit. Newspapers and commentators suggested the company, which backed Remain, may be trying to profiteer off the back of Brexit.

However, the data suggests the wholesale cost in sterling of many key foodstuffs has increased substantially since June. The new figures, produced by the data consultancy firm Mintec, compare the prices of key ingredients today to the day before the Brexit vote in June.

The Mintec figures suggest a tonne of New Zealand butter costs 58% more than it did in June, while sugar costs 37% more, beef is up 33%, pork is up 18%, and wheat is up 17%.

Mintec

This table shows the change since the EU referendum in the price of a selection of foodstuffs. The left-hand columns show the price changes in pound sterling, while the right-hand column shows the price change in the foodstuff’s native currency.

For everything except cocoa – which is traded in sterling – the UK has seen bigger price rises.

For everything except cocoa – which is traded in sterling – the UK has seen bigger price rises.

The key driver of many of the increased prices is the drop in the value of the pound, which has fallen around 17% since the day of the EU referendum.

These figures don’t mean prices on the supermarket shelf will go up this dramatically, or immediately. Food suppliers generally agree contracts with fixed prices for around six months or so, which delays the impact of price rises.

Consumer prices will also rise by less than this as ingredients are just one of many costs in the supply chain. However, within around a year or so price changes are passed to the consumer.

Helen Dickinson, CEO of the British Retail Consortium, which represents supermarkets and retailers, tacitly acknowledged in an emailed press release on Thursday that there is “inflationary” pressure in the food supply chain, and said retailers will not be able to absorb it.

“Retailers are firmly on the side of consumers in negotiating with suppliers and improving efficiencies in the supply chain to control the inflationary pressure that is building through the devaluation of the pound,” she said.

“However, years of falling shop prices and higher costs have left limited scope for retailers to continue absorbing this pressure, and everyone in the supply chain will need to play their part in maintaining low prices for consumers.”

A food supplier contacted by BuzzFeed News confirmed the pressure.

“The reality is that costs are increasing for every supplier,” he said. “Right now, every supplier is having a debate about what to do.”

Mintec noted that the food sector would be particularly affected by the weakened pound.

“For UK exporters, a weaker GBP is positive in the short term as it makes British products more competitive on the global market, driving higher demand,” it noted in a blog post.

“On the flip side, goods imported into the UK would be more expensive. Around 40% of all food consumed in the UK is imported, with over 70% of total food and drink imports from the EU.”

Saturday 15 October 2016

Theme 3: Tesco Vs Unilever (Monopsony Vs Monopoly)

In what has been dubbed the "Marmite War", Tesco has pulled many Unilever products from their online store over a dispute about raising prices. Products such as Marmite, Ben and Jerry's ice cream, Flora and Persil are no longer available because Unilever is pushing for 10 per cent price rises across the board to cover the rising costs of imports following the depreciation of sterling since June 2016.

A lower pound makes import prices more expensive in £s but Tesco is reluctant to raise their prices because of increasingly fierce competition with discount retailers such as Aldi and Lidl.

Retail profit margins have been squeezed over recent years and Aldi and Lidl have more products supplied under a private label and they source more of their processed foods from within the UK. They concentrate on fewer less well known brands at more competitive prices.

Which business will buckle first? Both Tesco and Unilever have significant market power and the likely outcome will likely be a trade-off between the two corporate giants. Price rises are inevitable when the exchange rate falls by more than 15% but not all of the (anglo-Dutch) Unilever's products sold in the UK are produced in overseas countries. Unilever's profit margins are also quite small. What we are seeing here is a battle for profitability across the supply chain.

Readers will be relieved to hear that I have managed by guarantee enough Marmite to last me for the next ten years by purchasing one jar from my local supermarket.

Thursday 13 October 2016

Theme 3: Tesco removes branded products from shelves

Click here to access a really interesting article on how firms are operating as a result of the fall in the value of the pound.

Could you draw a cost and revenue curve diagram, highlighting the potential issues facing Tesco and it's profits.

Can you also relate this to game theory and how an oligopolistic firm competes.

Could you draw a cost and revenue curve diagram, highlighting the potential issues facing Tesco and it's profits.

Can you also relate this to game theory and how an oligopolistic firm competes.

Labels:

brexit,

depreciation,

food inflation,

game theory,

tesco

Tuesday 11 October 2016

Theme 4: The synoptic paper - a presentation

This was a presentation from a recent INSET I attended. Still relevant for Y13 students about to tackle paper 3 for the fist time.

Sunday 9 October 2016

Thursday 6 October 2016

Theme 3: Oligopoly Presentation

Continuing from what we covered in the lesson, work your way up to slide 23 and have a look at collusion in your new textbooks.

Wednesday 5 October 2016

Theme 4: Globalisation - The elephant in the room!

I read an article today which highlights some of the issues surrounding globalisation and who has benefited the most from it. On Thursday, 6 October the BBC will be reporting from around the world on the impact of globalisation on people's lives and on the growing movement against free trade.

Click here to read the article.

There will be special coverage on TV, radio and online. Globalisation is the major topic for macro economics this year. So any article I post will be of great help for both paper 2 and paper 3.

Click here to read the article.

Tuesday 4 October 2016

Monday 3 October 2016

Them 3 - Exam question

(d) Examine the likely reasons Hanson chose to grow ‘through a number of mergers,

to become one of the world’s biggest companies’(Extract C lines 18 and 19). (8)

(e) Discuss the likely impact of the demerging of conglomerates on efficiency.(15)

Theme 1 & 3: North Korean Airline - Inferior Goods and how firms compete (or don't!)

Perhaps for those North Koreans permitted to fly Air Koryo on one of the few domestic flights or four international routes, a journey with the world's worst-rated airline might be a sign of luxurious privilege and political standing. But as this short video makes clear, life on board Air Koryo - consistently rated as the worst airline in the world - is pretty basic. In fact, it's the only airline with a one-star rating on airline-review site Skytrax. A useful clip when dicussing inferior goods (partly because the airline food looks so appetising) and how inefficient a local monopoly might be.

Sunday 2 October 2016

Theme 1 & 3: The problem with vertical, horizontal & conglomerate intergration

Click here to access an article which shows how a franchise used by Tesco employs Romanian workers at half the minimum wage.

Labels:

car wash,

franchise,

minimum wage,

romanian,

tesco

Subscribe to:

Posts (Atom)