What is the accelerator effect?

The accelerator effect happens when an increase in national income (GDP) results in a proportionately larger rise in capital investment spending. In other words, we often see a surge in capital spending by businesses when an economy is growing quite strongly.

How can the accelerator effect come about?

Consider an industry where demand is rising at a strong pace.

Firms will respond to growing demand by expanding production and making fuller use of their existing productive capacity. They may also choose to meet higher demand by running down their stocks of finished products.

At some point – and if they feel that the higher level of demand will be sustained – they may choose to increase spending on capital goods such as plant and machinery, factories and new technology in order to increase their capacity. If this investment goes beyond what is needed simply to replace worn out, fully depreciated machinery, then the capital stock of the business will become larger.

In this sense, the demand for capital goods is being driven by the demand for the products that the firm is supplying to the market. This gives rise to the accelerator effect - the principle states that a given change in demand for consumer goods will cause a greater percentage change in demand for capital goods.

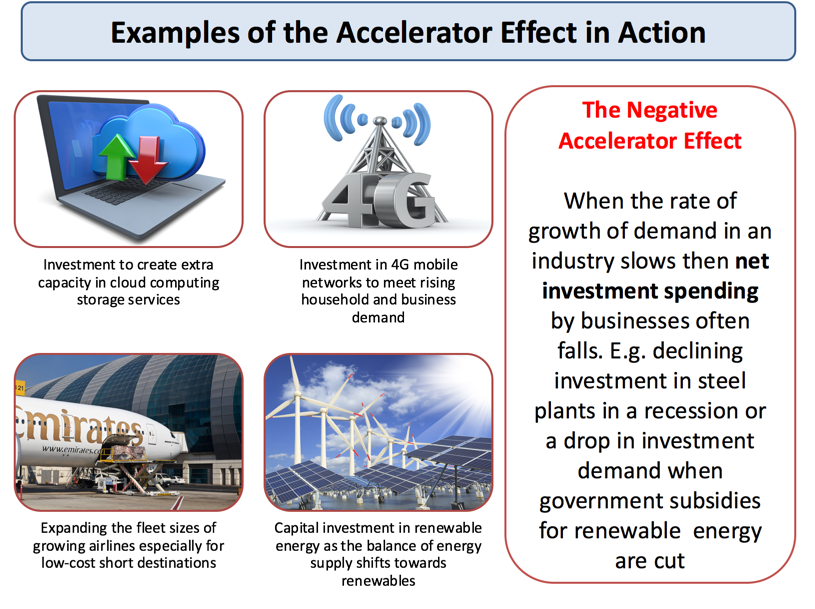

A good example might be the surge in capital investment in wind turbines due to the super-high level of oil and gas prices and a rising market demand for renewable energy. In this case, strong demand created a positive accelerator effect.

But this can also go into reverse e.g. during an economic slowdown or recession. World oil prices have collapsed and many wind farm projects have been scaled back or postponed because the economic viability of renewable energy has worsened.

Explaining the importance of the Capital Output Ratio

- The accelerator model works on the basis of a fixed capital to output ratio

- For example if demand in a given year rises by £4 million and each extra £1 of output requires an average of £3 of capital inputs to produce this output, then the net level of investment required will be £12 million.

One criticism of this simple accelerator model is that the capital stock of a business can rarely be adjusted immediately to its desired level because of ‘adjustment costs’ and ‘time lags’. The adjustment costs include the cost of lost business due to installation of new equipment or the financial cost of re-training workers. Firms will usually make progress towards achieving an optimum capital stock rather than moving smoothly from one optimal size of plant and machinery to another.

A further criticism of the basic accelerator model is that it ignores the spare capacity that a business might have at their disposal and also their ability to outsource production to other businesses to meet a short term rise in demand.

How does the accelerator effect help to explain the economic cycle?

- The accelerator principle is used to help explain business cycles.

- The accelerator theory suggests that the level of net investment will be determined by the rate of change of national income.

- If national income is growing at an increasing rate then net investment will also grow, but when the rate of growth slows net investment will fall.

- There will then be an interaction between the multiplier and the accelerator that may cause larger fluctuations in the trade cycle.

Summary - when will the accelerator effect be strongest?

The accelerator effect will tend to be high when

- The rate change of consumer income and spending is strongly positive

- The amount of spare productive capacity for businesses is low

- The available supply of investment funds is high

No comments:

Post a Comment