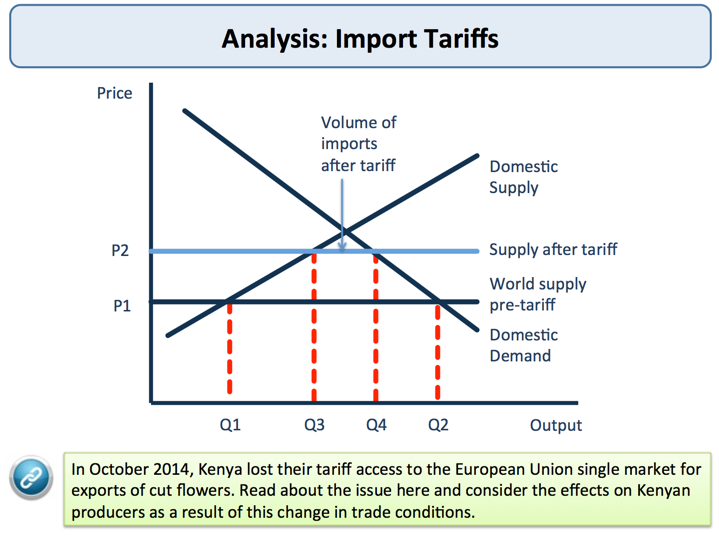

Import tariffs are a form of protectionism.

Tariffs aim to protect domestic industries from overseas competition by increasing the relative price of imports, thereby causing a fall in import demand.

Thus a higher proportion of domestic demand will be met from domestic suppliers.

Tariffs can also generate tax revenues for the governments who levy tariffs. Indeed, for many lower and middle-income countries, import tariffs are an important source of tax revenues.

A reduction in the quantity of and total spending on imports as a result of the import tariff may also improve a nation’s trade balance.

Protectionism represents any attempt to impose restrictions on trade in goods and services

Trade disputes between countries happen because one or more parties either believes that trade is being conducted unfairly, on an uneven playing field, or because they believe that there is one or more economic or strategic justifications for import controls.

All countries operate with some forms of import controls

The aim is to cushion domestic businesses and industries from overseas competition and prevent the outcome resulting from the inter-play of free market forces of supply and demand.

Different forms of protectionism

- Tariffs - a tax or duty that raises the price of imported products and causes a contraction in domestic demand and an expansion in domestic supply. For example, until recently, Mexico imposed a 150% tariff on Brazilian chicken. The United States has an 11% import tariff on imports of bicycles from the UK.

- Quotas – these are quantitative (volume) limits on the level of imports allowed or a limit to the value of imports permitted into a country in a given time period. Until 2014, South Korea maintained strict quotas on imported rice. It has now replaced an annual import quota with import tariffs designed to protect South Korean rice farmers. Quotas do not normally bring in any tax revenue for the government

- Voluntary Export Restraint – this is where two countries make an agreement to limit the volume of their exports to one another over an agreed time period. Sometimes this is enforced by a government for example the USA enforced VER on Japan during the late 1980s

- Intellectual property laws e.g. patents and copyright protection

- Technical barriers to trade including product labeling rules and stringent sanitary standards. These increase product compliance costs and impose monitoring costs on export agencies. Huge vertically integrated businesses can cope with these non-tariff barriers but many of the least developed countries do not have the some technical sophistication to overcome these barriers.

- Preferential state procurement policies – this is where a government favour local/domestic producers when finalizing contracts for state spending e.g. infrastructure projects or purchasing new defence equipment

- Export subsidies - a payment to encourage domestic production by lowering their costs. Soft loans can be used to fund the dumping of products in overseas markets. Well known subsidies include Common Agricultural Policy in the EU, or cotton subsidies for US farmers and farm subsidies introduced by countries such as Russia. In 2012, the USA government imposed tariffs of up to 4.7 per cent on Chinese manufacturers of solar panel cells, judging that they benefited from unfair export subsidies after a review that split the US solar industry.

- Domestic subsidies – government help (state aid) for domestic businesses facing financial problems e.g. subsidies for car manufacturers or loss-making airlines.

- Import licensing - governments grants importers the license to import goods.

- Exchange controls - limiting the foreign exchange that can move between countries – this is also known as capital controls

- Financial protectionism – for example when a national government instructs banks to give priority when making loans to domestic businesses

- Murky or hidden protectionism - e.g. state measures that indirectly discriminate against foreign workers, investors and traders. A government subsidy that is paid only when consumers buy locally produced goods and services would count as an example. Deliberate intervention in currency markets might also come under this category.

Quotas, embargoes, export subsidies and exchange controls are examples of non-tariff barriers

Examiner’s tip: the tariff is frequently examined. Ensure that you can analyse the removal as well as the imposition of a tariff.

No comments:

Post a Comment