Please take some time to look at these presentations. They cover the whole AS and A2 syllabus, are simple and (hopefully) easy to understand.

Remember, to come and ask me or any member of the faculty questions you may have.

Also here is a definitions textbook you may want to purchase.

I don't think anybody has any idea what the economic impact of Brexit will be. Steve Eisman

Total Pageviews

Tuesday, 17 December 2013

Thursday, 12 December 2013

Unit 1: How to draw externality/welfare loss diagrams

You lot tend to struggle with drawing externality diagrams. Check out this flowchart to help you to get to grips with them. The chart flows from left to right.

Tuesday, 10 December 2013

Unit 1: Demand & Price

Remember, it's not just price that effects demand....check out this clip for the brilliant film, 'The Hudsucker proxy'.......

What would the kid have done to the demand curve for Hula Hoops?

What would the kid have done to the demand curve for Hula Hoops?

Sunday, 8 December 2013

Unit 2 & 4: Osbourne's Autumn Statement

Chancellor George Osborne has updated MPs on the state of the economy and the government's future plans in his Autumn Statement. The key points are outlined in this article.

Useful application marks for any question on UK Economic Policy.

Useful application marks for any question on UK Economic Policy.

Thursday, 5 December 2013

Unit 1: Positive & Negative Externalities

Revision presentations on externalities.

Click here for presentation on negative externalities.

Click here for presentation on positive externalities.

I will asking you to complete a case study from an exam papers next week, so please read carefully!

Click here for presentation on negative externalities.

Click here for presentation on positive externalities.

I will asking you to complete a case study from an exam papers next week, so please read carefully!

Tuesday, 3 December 2013

Economics Advent Calender

Time for a bit of festive cheer....here is an Economics Advent calender....no chocolate I'm afraid.....

Public Advientos

Public Advientos

Unit 1: Practice Paper

It's the time of year for tests people......Here's an AS practice paper for you to try.

Tuesday, 26 November 2013

Unit 1: Producer & Consumer subsidies

Here is a revision presentation on the economics of producer and consumer

subsidies as forms of government intervention in markets. There are a number of

up to date examples highlighted together with an evaluation of the benefits and

costs of subsidy payments. This is designed as a revision aid for unit 1

students taking their microeconomics papers.

Unit 4: Inequality & Economic development

This is an updated revision presentation covering aspects of inequality and

economic growth/development - it is designed for specifically for the Unit 4 paper.

Unit 2 & 4: The Multiplier effect

Definition: An initial change in aggregate demand can have a much greater final impact on

the level of equilibrium national income.

This is known as the multiplier effect.

It comes about because injections of new demand for goods and services into the circular flow of income stimulate further rounds of spending – in other words “one person’s spending is another’s income." This can lead to a bigger eventual effect on output and employment.

Questions for discussion: What implications does the multiplier effect have for economic policy decisions?

This is known as the multiplier effect.

It comes about because injections of new demand for goods and services into the circular flow of income stimulate further rounds of spending – in other words “one person’s spending is another’s income." This can lead to a bigger eventual effect on output and employment.

Questions for discussion: What implications does the multiplier effect have for economic policy decisions?

Unit 3: Anti-Competitive practice in the UAE!

Etisalat rapped by telecoms watchdog for blocking rival's number - 7 Days Article

The rivalry between the UAE's two mobile operators was laid bare on Monday.

It came after the country’s telecoms watchdog said Etisalat breached its rules by blocking a number set up by du to lure away its customers.

The Telecommunications Regulatory Authority (TRA) has “issued a violation decision against Etisalat” after the country’s biggest telecoms firm failed to respond to the regulator’s request to lift a block on a ‘short code’ number used by du for an SMS offer.

.

-

The Telecommunications Regulatory Authority (TRA) has “issued a violation decision against Etisalat” for blocking a du number

The Telecommunications Regulatory Authority (TRA) has “issued a violation decision against Etisalat” for blocking a du number

Last week du launched a media campaign aimed at encouraging Etisalat customers to “indicate their interest in shifting to du” when UAE mobile customers are next month finally given the option of keeping their old number after changing operators. The campaign invited customers to send an SMS to the number 3553, after which they would receive a message from du with details of how to change.

However, the regulator said: “It came to the TRA’s attention that the short code 3553 had been blocked by Etisalat.”

The watchdog added: “This meant Etisalat mobile subscribers who sent a message to the short code did not receive a response from du. It is understood that this block has been in effect since around November 21, 2013.”

The latter date marks the day after du started publicising its campaign. The TRA said it instructed Etisalat “to immediately lift the block” on the 3553 code “and any other short codes used by du to promote its products and services”.

The watchdog then said it moved to issue the UAE’s largest telecom operator with a violation decision “in response to Etisalat’s failure to comply with these instructions”. A source at the TRA yesterday confirmed that such a step would involve a financial penalty for Etisalat.

Last month, the TRA announced that Mobile Number Portability (MNP) - the formal name for being able to hold onto your number after changing operators - would be introduced before the year is out.

Last night du called Etisalat’s blocking of the number “an unfortunate turn of events”.

In a statement, the firm said: “Despite this temporary setback, which interrupted our ability to reach out to customers who are interested in MNP, we believe that forming a competitive atmosphere in the country is a vital and healthy practice, which is in line with the UAE leadership’s vision.

“Du came into being in the UAE market in compliance with the objective of giving choice in telecom services to people.”

Etisalat had not responded to a request for comment last night.

Questions for discussion:

What type of market structure is the telecommunications industry in the UAE? (4)

What punishment could the regulator give to Etisalat and how effective would this be? (8)

Monday, 25 November 2013

Unit 3: Pricing Strategies for the PS4

The launch of Sony's PS4 alongside Microsoft's XBox One signals the beginning of a highly intense competitive battle in the oligopolistic games console market. With both the new consoles being launched in time for the crucial Christmas sales period, pricing strategy is crucial in order to gain maximum market share.

In the US, Sony has priced the PS4 at $399 (retail). Of course that is the retail price. Distributors will be wanting to make their margin on each unit sold. So how much does it cost Sony to make a new PS4?

This video take a look at the individual component and assembly costs of a PS4. The experts involved estimate that the unit cost of a PS4 is $332 which comprises:

- Processor: $121

- Memory: $64

- Hard drive: $23

- Blu-ray drive $20

- Power management & audio controls: $16

- WiFi chip: $8

- Other components & assembly: $80

The unit cost of $332 does not include packaging or the dual-shock controller which ships with the console. Allowing for a retailer's margin or mark-up, that suggests that Sony is pricing the PS4 at substantially below the variable cost of the console. This is a classic example of a loss-leader. Sony is aiming to grab maximum market share in terms of console units sold, making its main revenues from games licensing and other add-ons.

Possible examination question - Assess the effectiveness of this pricing strategy for Sony (12 Marks)

Saturday, 23 November 2013

Unit 4: Classical Economists fail their own test!

|

| I'll be back! |

Wednesday, 20 November 2013

Unit 3: Game theory & Supermarkets

There has been lots of talk in the media recently about the supermarkets’ Christmas advertising campaigns.

Sainsbury’s have employed an Oscar winning director for their campaign, although he failed to spot the Co-op’s own brand range in the background, Tesco stole a march on the others by starting their advertising campaign on a Friday, which makes a lot of sense, but Asda wanted to get maximum exposure by launching their campaign during X-Factor, the most watched program on commercial television. No doubt Morrison’s will be launching their Christmas campaign sometime in late January….

From an economic point of view, why do they do this? It makes very little sense as 90% of grocery shopping in the UK is already done in supermarkets, most of their customers will spend more at Christmas anyway, so why do they need to spend millions of pounds on extravagant marketing campaigns?

In fact, the only people they are likely to attract are their own customers, or people who shop at supermarkets anyway, there is likely to be very little extra custom from new sources, so it all seems like a bit of a waste of money.

The reasoning behind it is that the supermarket chains fear nothing more than losing a customer to their rivals during the festive season, or, indeed, at any time of the year. As most economists will have read in Freakonomics, it makes little economic sense for supermarkets to be open 24 hours a day, the extra costs involved mean they simply lose money by doing so, but they are playing a game. If, that one time, one of their customers needs to shop at 3am, and they are not open, what will the customer do? S/he will go to a rival supermarket. No big deal you might think, they will only be spending a tiny percentage of their annual supermarket spend, so it will have no real impact on market share…

BUT, what if that customer really likes this different shopping experience? What if they try a different product and like it? Where will they shop next time? That is a lot of revenue potentially lost by being closed at 3am, so they stay open, particularly in areas of high competition, just in case.

This is essentially the same reason that they spend so much on their Christmas campaigns. If Tesco decided it wasn't going to ‘waste’ money on advertising this year, as they only attract a small percentage of new customers, their customers may be tempted by the luxurious nature of Sainsbury’s campaign, and Tesco may never see that customer again.

People spend more in supermarkets in December than in any other month, regardless of advertising, so it would make sense for the supermarkets to get together and decide that none of them should advertise over the festive season. This would save each chain many millions of pounds, which they could either plough into dynamically changing the shopping environment for the better, or into price reductions for customers.

I can imagine the meeting now:

Tesco Marketing Director:

We see the benefits of not conducting a Christmas advertising campaign, and if you won’t do one, we won’t do one.

Sainsbury’s Marketing Director:

We agree that it serves us all not to spend this money in this area, we won’t do one either

Asda Marketing Director:

Yeah, it’s a pinky promise from us too.

And they each go off and spend millions developing an advertising campaign for the month of December! Classic Game Theory. The incentive to cheat is too high, because if Tesco do a campaign and the others don’t, they will be swamped with custom, whereas Sainsbury’s and Asda will be left with an awful lot of unsold stock, so whilst, in theory, it makes sense for them not to advertise, in practice they always will. As a result, we all have to see sickening Christmas images and we have to try and live up to expectations….

Tuesday, 19 November 2013

Unit 3: Prisoners Dilemma - We are all going to die! :-)

A rather scary but neat way of showing the escalation risk in the nuclear arms race, and race to the bottom / Prisoners' Dilemma that exists in this field.

Japanese artist Isao Hashimoto has created a time-lapse map of the 2053 nuclear explosions which have taken place between 1945 and 1998, beginning with the Manhattan Project’s “Trinity” test near Los Alamos and concluding with Pakistan’s nuclear tests in May of 1998.

Each nation gets a blip and a flashing dot on the map whenever they detonate a nuclear weapon, with a running tally kept on the top and bottom bars of the screen. 1960s was a bit scary!

Wednesday, 13 November 2013

Unit 4: Interesting look at UAE Vs the world

Click here to access an article from the National newspaper which ranks UAE in terms of many variables, from Military spending to the price of a Big Mac.

Useful for assessing economic development....

Useful for assessing economic development....

Unit 4: Living Standards - how should we measure them?

Click here to access an interactive graphic highlighting the different ways we can use to measure standards of living in different countries. Extremely useful when comparing countries at different stages of economic development.

Related exam questions:

Related exam questions:

What problems occur when economists link policy to GDP per Capita when trying to impove living standards. (30 Marks)

Evaluate four ways in which economic

growth and development might be promoted in developing countries. (30 Marks)

Sunday, 10 November 2013

Saturday, 9 November 2013

Unit 1: Buffer stock system and agriculture

Absolutely essential reading for all students in Y12. Agriculture comes up EVERY year, so you need to make sure you understand ALL aspects.

Friday, 8 November 2013

Unit 3: Price capping and the energy market - does it work?

Thanks to Geoff Riley from tutor2u for this piece, great analysis and evaluation points for any question on regulation.

Ed Miliband’s promise at the Labour Party conference to cap energy prices for 20 months if Labour were to win the next election, has raised many questions about what we pay for domestic energy, how it compares with other countries, and what the energy companies do with their profits.

Pondering those points has led me to an over-riding question, which is whether the price paid by consumers is really the most important issue for government intervention in the energy market.

Ed Miliband’s promise at the Labour Party conference to cap energy prices for 20 months if Labour were to win the next election, has raised many questions about what we pay for domestic energy, how it compares with other countries, and what the energy companies do with their profits.

Pondering those points has led me to an over-riding question, which is whether the price paid by consumers is really the most important issue for government intervention in the energy market.

Tuesday, 5 November 2013

Privatisation... Why Mr Oates finds it hard to defend

Rail privatisation: legalised larceny | Aditya Chakrabortty read the article here

147 roi? So much for the privatisation argument. Anyone seen royal mail share prices lately? Can anyone find vinces liberal membership?

Monday, 4 November 2013

Unit 4: Development strategies - micro-financing

An interesting article on how small loans don't have top be given out at ridiculous rates of interest, aka Wonga.com)

Muhammad Yunus is an economist and Nobel Peace Prize winner who has further developed the concepts of microcredit and micro-finance. In 2006 Muhammad Yunus and Grameen Bank received the Nobel Peace Prize for their work in microcredit and their efforts to create economic and social development.

How it works

The concept of micro-credit loans is centered on the idea that the poor have not been able to fully utilize their skills and thus with right incentive can earn more money. When providing loans, Grameen bank uses a group-based credit approach in order to make sure that social pressure within rural communities ensures that borrowers uphold their end of the contract (making repayments on time and achieving a good credit standing).

Grameen bank’s credit policy focuses on providing the under-served populations with support and as a result 94% of its borrowers are women. In most developing nations like Bangladesh, gender inequality is still a major issue. Grameen Bank helps empower women by mainly providing them with the micro-credit loans, which in turn offers them the opportunity of self-employment and access to money.

In addition, reports have proven that the overall impact on development is greater when loans are given to women as opposed to men since women are more likely to use their earnings to improve their living situations and to educate their children. The value of loans starts at $35 and average $200 but mainly depend on the needs of the borrower and her level of credit (based on their previous borrowing and repayment record).

Since the bank’s primary focus is on alleviating poverty rather than generating high returns, interest rates are kept relatively low and as close as possible to commercial rates.

Further Projects

Given its success, Grameen bank has diversified its services among different applications of microcredit. The Village Phone program allows female entrepreneurs to start businesses that provide wireless payphone services in rural areas. The Program has improved the livelihoods of many villagers, farmers and other people who previously did not have access to critical market information and lifeline communications in over 28,000 villages in Bangladesh. Today, more than 55,000 phones are being utilised, with over 80 million people benefiting from access to market information.

In 2003, Grameen Bank launched it struggling members program, exclusively targeted to the beggars in Bangladesh rather than its famous traditional group-based lending scheme. This program distributes small loans to beggars. The loans are interest-free, the repayment period can be arbitrarily long, and the borrower is covered under life insurance free of cost. For example, a beggar taking a small loan of around 100 taka (about US $1.50) may pay back only 2.00 taka (about 3.4 US cents) per week.

Lessons from Grameen Bank’s success

Providing the poor with micro-credit loans can help spur economic growth. Companies such as M-PESA have also implemented the idea of micro-finance in Africa as well. Although they do not function like Grameen Bank, both companies rely on the idea that financial inclusion and helping the poor fulfill their potential is necessary for development. Efforts are being made all over the world to embrace this idea (e.g. Nepal) as it can ultimately help lift the poorest out of poverty.

Related exam questions:

(a) Assess the causes of absolute poverty in a developing country of your choice (20)

(b) To what extent is reducing the number of people living in absolute poverty

sufficient to achieve economic development? (30)

Muhammad Yunus is an economist and Nobel Peace Prize winner who has further developed the concepts of microcredit and micro-finance. In 2006 Muhammad Yunus and Grameen Bank received the Nobel Peace Prize for their work in microcredit and their efforts to create economic and social development.

How it works

The concept of micro-credit loans is centered on the idea that the poor have not been able to fully utilize their skills and thus with right incentive can earn more money. When providing loans, Grameen bank uses a group-based credit approach in order to make sure that social pressure within rural communities ensures that borrowers uphold their end of the contract (making repayments on time and achieving a good credit standing).

Grameen bank’s credit policy focuses on providing the under-served populations with support and as a result 94% of its borrowers are women. In most developing nations like Bangladesh, gender inequality is still a major issue. Grameen Bank helps empower women by mainly providing them with the micro-credit loans, which in turn offers them the opportunity of self-employment and access to money.

In addition, reports have proven that the overall impact on development is greater when loans are given to women as opposed to men since women are more likely to use their earnings to improve their living situations and to educate their children. The value of loans starts at $35 and average $200 but mainly depend on the needs of the borrower and her level of credit (based on their previous borrowing and repayment record).

Since the bank’s primary focus is on alleviating poverty rather than generating high returns, interest rates are kept relatively low and as close as possible to commercial rates.

Further Projects

Given its success, Grameen bank has diversified its services among different applications of microcredit. The Village Phone program allows female entrepreneurs to start businesses that provide wireless payphone services in rural areas. The Program has improved the livelihoods of many villagers, farmers and other people who previously did not have access to critical market information and lifeline communications in over 28,000 villages in Bangladesh. Today, more than 55,000 phones are being utilised, with over 80 million people benefiting from access to market information.

In 2003, Grameen Bank launched it struggling members program, exclusively targeted to the beggars in Bangladesh rather than its famous traditional group-based lending scheme. This program distributes small loans to beggars. The loans are interest-free, the repayment period can be arbitrarily long, and the borrower is covered under life insurance free of cost. For example, a beggar taking a small loan of around 100 taka (about US $1.50) may pay back only 2.00 taka (about 3.4 US cents) per week.

Lessons from Grameen Bank’s success

Providing the poor with micro-credit loans can help spur economic growth. Companies such as M-PESA have also implemented the idea of micro-finance in Africa as well. Although they do not function like Grameen Bank, both companies rely on the idea that financial inclusion and helping the poor fulfill their potential is necessary for development. Efforts are being made all over the world to embrace this idea (e.g. Nepal) as it can ultimately help lift the poorest out of poverty.

Related exam questions:

(a) Assess the causes of absolute poverty in a developing country of your choice (20)

(b) To what extent is reducing the number of people living in absolute poverty

sufficient to achieve economic development? (30)

Friday, 1 November 2013

Growth vs Life?

How economic growth has become anti-life | Vandana Shiva read the article here

Some interesting points about patented seeds which are forcing farmers into poverty despite the idea that gm crops are supposed to be the answer to world poverty...

Wednesday, 30 October 2013

Unit 3: Oligopoly, price wars and unfair competition.

A battle between rival supermarkets

Tesco and Sainsbury's over price comparison promotions may go to court. Click here to access the full article.

Here is a further article on price wars. Can all supermarkets be the cheapest?

Questions for discussion:

Assess the impact this form of competition will have on the consumer. (12 marks)

Here is a further article on price wars. Can all supermarkets be the cheapest?

Questions for discussion:

Assess the impact this form of competition will have on the consumer. (12 marks)

Sunday, 27 October 2013

Wednesday, 23 October 2013

Sunday, 20 October 2013

Warning All Economics Students

You are at risk of developing risky credit activities in later life as a result of studying Economics... Read THIS article to find out more.

Unit 3: Gas Oligopoly and Price Leadership

The market for retail gas supplies is mired in controversy and threats of direct government intervention to freeze prices should a new Labour government be elected in 2015. This week we have seen a classic example of the type of price leadership we expect to see in an oligopoly.

Hot on the heels of a steep rise in prices from SSE a few days earlier (SSE announced an 8.2% increase in domestic bills from 15 November) British Gas has announced that their own energy prices will jump by an average of 9.2% from November 2013. The average annual dual-fuel bill with British Gas will increase by £107 to £1,297.

Centrica argued that the climbing price is mainly due to higher costs for wholesale energy and delivering gas and electricity to homes, and the impact of the Coalition government's "social and (green) environmental programmes" which are paid for through customers' bills.

But now that two of the leading six suppliers have taken the decision to lift energy bills for household, commercial and industrial users, it can only be a matter of time before EDF, E.ON, npower and Scottish Power follow suit - this is a process known as price leadership and will be well understood by students of the oligopoly market structure.

One of the consequences of the frequent gas and electricity price hikes has been a substantial fiscal dividend for the UK treasury as this news article in the Telegraph makes clear.

Saturday, 19 October 2013

Unit 2: Inflation - Winners & Losers

Inflation: different impacts on different people

How bad is inflation? Like any good answer, your response to this question will include an element of evaluation, probably wrapped up in a sentence containing the phrase "it depends". With inflation, the impact is significantly influenced by who you are. Stated simply, different groups of people have different experiences of inflation.

The best way to understand why this is the case is to remind yourself how inflation is calculated. The key concept is that there is an imaginary basket of goods (see above) which attempts to capture the average spend of the average household. The thing is, you're not average - so you have your own experience of inflation.

I've grouped together several articles on the subject of the measurement of inflation here, including the one discussed below.

Inflation is in the news this week, but my eyes have been drawn to a terrific article in The Economist that should be recommended reading to anyone who is interested in this topic. The main points being made are summarised in these two graphs that appear in the article:

Firstly, the fact that inflation is an average of the change in many prices:

Secondly, because different groups have different spending patterns, they experience different rates of inflation:

Unit 4: Primary Product Dependency

On the World Bank twitter account, President Jim Kim is quoted as saying that

"Properly managed, new minerals wealth could transform Africa’s development."

Back in June 2013, a new report from the African Progress Panel looked at this

important issue and set out an agenda for maximising Africa’s natural resource

wealth and using it to improve well-being.

Related essay Q's:

*(a) To what extent is primary product dependency a constraint on economic growth

and development in developing countries? (20)

*(b) Evaluate four ways in which economic growth and development might be

promoted in developing countries. (30)

Related essay Q's:

*(a) To what extent is primary product dependency a constraint on economic growth

and development in developing countries? (20)

*(b) Evaluate four ways in which economic growth and development might be

promoted in developing countries. (30)

Unit 1: Supply & Demand in action

Classic supply side factors in play in the article here

Questions to ask yourself for Unit 1

What kind of a good is sugar and is it elastic or inelastic?

Demonstrate the impact on a Supply & Demand diagram of a fire affecting Sugar Supplies from the main worldwide exporter.

Why is it that although export levels should remain the same from Brazil due to plentiful buffer stock there has been a price rise? Use another Supply & Demand diagram to explain this.

Labels:

supply and demand,

supply side factors,

Unit 1

Thursday, 10 October 2013

Unit 1: Falling coffee prices - farmers switch to Oranges

Here is a familiar tale - sharply falling world coffee prices are causing the terms of trade to drop and threatening the commercial viability of coffee production among many of Indonesia's small scale coffee farmers. Can stronger marketing and investment in processing help these farmers move up the value chain?

The price of coffee in Indonesia has dropped to a third of the price from one year ago, due to an oversupply of it in the world's market. This has caused many coffee farmers in Indonesia to stop growing coffee and switch to other plants, such as oranges.

Questions for discussion:

Why are coffee prices falling?

What does this say about the elasticity of supply of coffee?

Y12 Students should look in their exam packs at related questions. There are several on agricultural produce and some link to this elasticity issue.

Some of you may wish to think of questions yourself and prepare a case study question based con this information.

Thursday, 3 October 2013

Unit 3: Economies, diseconomies of scale and natural monopolies

Excellent presentation on Economies and Diseconomies of scale. Also useful when revising Natural Monopolies.

Unit 3: Business growth, integration

Revision presentation on business growth, business integration and the factors affecting the shareholder returns from merger and takeover activity.

Related Exam Questions - all case studies will have some element of the above. Essential knowledge for successful exam results.

Related Exam Questions - all case studies will have some element of the above. Essential knowledge for successful exam results.

Wednesday, 2 October 2013

Unit 3: Past Questions on 'Game Theory'

Past Questions on Game Theory

Jan 11:

Game theory can be used to illustrate which of the following

examples of competitive

behaviour?

A Price leadership in perfect competition

B Revenue maximisation in monopolistic competition

C Limit pricing in monopolistic competition

D Tacit collusion in oligopoly

E Price discrimination by a monopolist.

Jun 10 Q9 Part C – 12 Marks

Jun 11 Q10 Part C – 12 Marks

Jan 12 Q9 Part D – 16 Marks

Jan 12 Q10 Part C – 12 Marks

Jun 13 Q9 Part D – 16 Marks

Tuesday, 1 October 2013

Unit 3: Monopsony Power in Qatar

A deeply troubling report featured here in the Guardian. Qatar, one of the richest countries on the planet, will be hosting the World Cup in 2022. But much of the Gulf state's expansion is being built by some of the poorest migrant workers in the world. In the worst cases, employees are not being paid and work in conditions of forced labour. Thousands of workers from Nepal are trapped in jobs and wages very different to what they were promised.

Thank you Klaus...I have updated the post to include Dubai workers clip as well.

Related Exam questions:

1 In August 2009 the Competition Commission published a Groceries Supply Code of

Practice. Large supermarket chains were paying very low prices to some suppliers.

Which type of market power does this suggest the large supermarket chains have?

(1)

A Monopsony

B Monopolistic competitive

C Perfectly competitive

D Natural monopoly

E Competitive monopoly

Thank you Klaus...I have updated the post to include Dubai workers clip as well.

Related Exam questions:

1 In August 2009 the Competition Commission published a Groceries Supply Code of

Practice. Large supermarket chains were paying very low prices to some suppliers.

Which type of market power does this suggest the large supermarket chains have?

(1)

A Monopsony

B Monopolistic competitive

C Perfectly competitive

D Natural monopoly

E Competitive monopoly

Saturday, 28 September 2013

Unit 4: Globalisation - Definitions

Globalisation is defined in many different ways – there is no textbook definition - but economic globalisation is usually characterised by some of the following features:

- - An increasing interdependence between economies and an erosion of national boundaries

- Increased cross-border activity from MNCs

- Increased cross-border flow of trade in goods and services, movement of people, flows of financial assets, hot money, and FDI flows

- The growth of labour migration and outsourcing and global supply chains

The OECD’s definition is: “The geographic dispersion of industrial and service activities, for example research and development, sourcing of inputs, production and distribution, and the cross-border networking of companies, for example through joint ventures and the sharing of assets”

One index that attempts to quantify and measure globalisation is called the KOF index.

- -The KOF Index of Globalization measures the three main dimensions of globalization:

Economic, Social and Political.

In constructing the index of globalisation, the variables that are included are:

Trade : (X+M) (percent of GDP)

Foreign Direct Investment stocks (inward and outwards) (percent of GDP) Portfolio Investment (percent of GDP)

Income Payments to Foreign Nationals (percent of GDP) World Bank (2011)

Mean Tariff Rate

Taxes on International Trade (percent of current revenue)

Capital Account Restriction

It also includes things like internet penetration (random fact: Finland in 2010 made access to broadband a human right - click here) and international letters per capita, to try to judge social globalisation. For a proxy for political globalisation they look at membership of international organisations, foreign embassies, signatory of international treaties.

They also look at the number of McDonald’s and Ikea stores per capita as a barometer of social globalisation.

This prompted one of the my pupils to ask how many countries in the world Macdonald’s was present in.

Google told me that the answer is… QUITE A LOT! ‘There are still 105 countries without the fast food giant, from Ghana to Jamaica to Yemen to Tajikistan…’

See the article here

(Which prompted another question from a pupil – the Big Mac Index published by the economist then is limited in its breadth if it skips half the world out!)

This makes it a good variable to look at since it is not as global as say Coca-Cola - Only two countries in the world where Coca-Cola isn’t: guess who? Answer here. (But perhaps the Economist should publish a Coca-Cola Index instead or a Starbucks index).

The 2013 KOF Index can be analysed in this press release.

“China: The second largest economy in the world, China, is ranked 73rd in the KOF Index of Globalization 2013. Compared to the previous year,China has moved up three positions. In terms of economic globalization, the People’s Republic has stayed put (currently:109th); it has gained three ranks in terms of social integration and is now ranked 90th.Owing to its involvement in international politics and its increasing importance, China is ranked 44th in the political globalization component (one place higher than in 2009).”

“USA: The USA has kept its position in the rankings of the previous year and is still 34th.The USA has lost ground in terms of economic globalization compared to the previous year.The USA is now ranked 82nd (previous year: 80th).As a large economy, a high proportion of its trade is internal which means that the USA does not“need”to be as globalized as small countries. The “Actual Flows”sub-indicator that includes trade and cash flows has fallen as a result ofthe financial and economic crisis. As in the majority of industrial nations, social globalization has remained at approximately the same level for several years (position 27),while the USA moved up 3 positions in terms of political globalization (Rank 19).”

It offers some interesting insight into the process of globalisation. Crucially it points out:

-That globalisation is a process, not an end state. The 2008-2012 crisis saw the world de-globalise

-There are vast differences between individual countries who are globalised and others who barely appear on the index – that is to say, generalisations about the globalisation process cannot be made (pupils were surprised where the U.S ranked)

-There is a big difference between globalisation and regionalisation – no coincidence that 13 of the top 15 most globalised countries are around Europe.

Exam Question: Unit 4 - June 12 Essay Q3

Unit 3: Natural Monopolies & Govt Regulation

A simply put video showing why monopolies are sometimes the most efficient form of market structure. (Natural Monopolies). It goes on to show how & why the government regulates these markets.....essential for Unit 3.

Related exam questions:

Unit 3: June 2007 Q12 - BT and competition

Related exam questions:

Unit 3: June 2007 Q12 - BT and competition

Wednesday, 25 September 2013

Unit 3: Government Regulation

Regulation of Markets

Why the Government Regulates Monopolies

- Prevent Excess Price. Without government regulation, monopolies could put prices above. This would lead to allocative inefficiency and a decline in consumer welfare.

- Quality of service. If a firm has a monopoly over the provision of a particular service, it may have little incentive to offer a good quality service. Government regulation can ensure the firm meets minimum standards of service.

- Monopsony power. A firm with monopoly selling power may also be in a position to exploit monopsony buying power. For example, supermarkets may use their dominant market position to squeeze profit margins of farmers.

- Promote Competition. In some industries, it is possible to encourage competition, and therefore there will be less need for government regulation.

- Natural Monopolies. Some industries are natural monopolies – due to high economies of scale, the most efficient number of firms is one. Therefore, we cannot encourage competition and it is essential to regulate the firm to prevent the abuse of monopoly power.

How the Government Regulate Monopolies

1. Price Capping by Regulators RPI-XFor many newly privatised industries, such as water, electricity and gas, the government created regulatory bodies such as:

- OFGEM – gas and electricity markets

- OFWAT – tap water.

- ORR – Office of rail regulator.

- X is the amount by which they have to cut prices by in real terms.

- If inflation is 3% and X= 1%

- Then firms can increase actual prices by 3-1 = 2%

RPI+/- K – for water industry

In water the price cap system is RPI -/+ K.

K is the amount of investment that the water firm needs to implement. Thus, if water companies need to invest in better water pipes, they will be able to increase prices to finance this investment.

Advantages of RPI-X Regulation

- The regulator can set price increases depending on the state of the industry and potential efficiency savings.

- If a firm cuts costs by more than X, they can increase their profits. Arguably there is an incentive to cut costs.

- Surrogate competition. In the absence of competition, RPI-X is a way to increase competition and prevent the abuse of monopoly power.

Disadvantages of RPI-X Regulation

- It is costly and difficult to decide what the level of X should be.

- There is danger of regulatory capture, where regulators become too soft on the firm and allow them to increase prices and make supernormal profits.

- However, firms may argue regulators are too strict and don’t allow them to make enough profit for investment.

- If a firm becomes very efficient, it may be penalised by having higher levels of X, so it can’t keep its efficiency saving.

Regulators can examine the quality of the service provided by the monopoly. For example, the rail regulator examines the safety record of rail firms to ensure that they don’t cut corners.

In gas and electricity markets, regulators will make sure that old people are treated with concern, e.g. not allow a monopoly to cut off gas supplies in winter.

3. Merger Policy

The government has a policy to investigate mergers which could create monopoly power. If a new merger creates a firm with more than 25% of market share, it is automatically referred to the Competition Commission. The Competition commission can decide to allow or block the merger.

More on mergers.

4. Breaking up a monopoly.

In certain cases, government may decide a monopoly needs to be broken up because the firm has become too powerful. This rarely occurs. For example, the US looked into breaking up Microsoft, but in the end the action was dropped. This tends to be seen as an extreme step, and there is no guarantee the new firms won’t collude.

5. Yardstick or ‘Rate of Return’ Regulation

This is a different way of regulating monopolies to the RPI-X price capping. Rate of return regulation looks at the size of the firm and evaluates what would make a reasonable level of profit from the capital base. If the firm is making too much profit compared to their relative size, the regulator may enforce price cuts or take one off tax.

A disadvantage of rate of return regulation is that it can encourage ‘cost padding’. This is when firms allow costs to increase so that profit levels are not deemed excessive. Rate of return regulation gives little incentive to be efficient and increase profits. Also, rate of return regulation may fail to evaluate how much profit is reasonable. If it is set too high, the firm can abuse its monopoly power.

6. Investigation of Abuse of Monopoly Power.

In the UK, the office of fair trading can investigate the abuse of monopoly power. This may include unfair trading practises such as:

- Collusion (firms agree to set higher prices)

- Collusive tendering. This occurs when firms enter into agreements to fix the bid at which they will tender for projects. Firms will take it in turns to get the contract and enable a much higher price for the contract.

- Predatory pricing (setting low prices to try and force rival firms out of business)

- Vertical restraints – prevent retailers stock rival products

- Selective distribution For example, in the UK car industry firms entered into selective and exclusive distribution networks to keep prices high. The competition commission report of 2000 found UK cars were at least 10% higher than European cars

Related Exam Question:

Jun 2009 Unit 3, Q11 - The rail industry

Labels:

government regulation,

monopoly,

revision material

Unit 3: Monopoly Revision Notes

Monopoly

Definition of Monopoly:

- A pure Monopoly is defined as a single seller of a product. i.e. 100% of market share.

- In the UK a firm is said to have monopoly power if it has more than 25% of the market share. For example, Tesco @30% market share or Google 90% of search engine traffic.

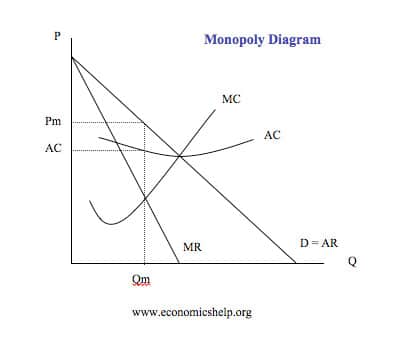

Monopoly Diagram

Problems of Monopoly

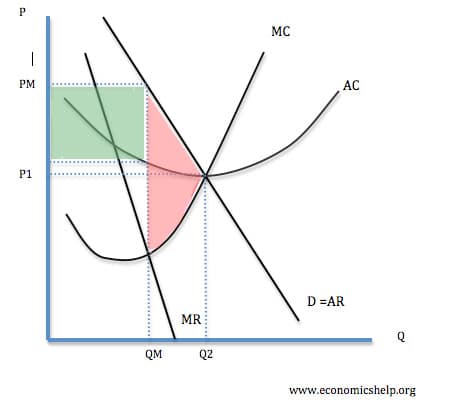

- Higher Prices. Firms with monopoly power can set higher prices than in a competitive market. (Green area is supernormal profit)

- Allocative Inefficiency. A monopoly is allocatively inefficient because in monopoly the price is greater than MC. (P > MC). In a competitive market the price would be lower and more consumers would benefit. A monopoly results in dead-weight welfare loss indicated by the red triangle.

- Productive Inefficiency A monopoly is productively inefficient because output does not occur at the lowest point on the AC curve.

- X – Inefficiency. – It is argued that a monopoly has less incentive to cut costs because it doesn’t face competition from other firms.Therefore the AC curve is higher than it should be.

- Supernormal Profit. A Monopolist makes Supernormal Profit Qm * (AR – AC ) leading to an unequal distribution of income.

- Higher Prices to suppliers - A monopoly may use its market power and pay lower prices to its suppliers. E.g. Supermarkets have been criticised for paying low prices to farmers.

- Diseconomies of acale - It is possible that if a monopoly gets too big it may experience diseconomies of scale. – higher average costs because it gets too big.

- Lack of incentives. A monopoly faces a lack of competition and therefore, it may have less incentive to work at product innovation and develop better products.

- Charge higher prices to suppliers. Monopolies may use their

supernormal profits to charge higher prices to suppliers.

- see also: Disadvantages of Monopolies

Advantages of Monopoly

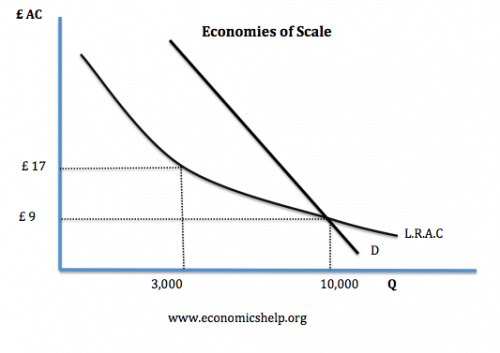

1. Economies of scale

- If there are significant economies of scale, a monopoly can benefit from lower average costs. This can lead to lower prices for consumers.

- In the above example If there were 3 firms producing 3,000 units at an average cost of £17, average costs would be higher than a monopoly producing 10,000 units. Therefore, for natural monopolies and industries with significant economies of scale, monopolies can be more efficient.

Monopolies make supernormal profit which can be invested in Research & Development. This is important for industries like medical drugs.

3. A Firm may gain monopoly power because it is the most efficient.

Google gained monopoly power through offering innovative new products. It is hard to argue google has x-inefficiency because of its monopoly power.

- see also: Advantages of Monopolies

Evaluation of Monopolies

- It depends on the industry in question. For example, a monopoly is needed in a natural monopoly like tap water. However, for restaurants, there are not significant economies of scale and it is important to have choice. Therefore monopoly would be very inappropriate for restaurants.

- Some industries need a lot of research and development (e.g. building new aeroplanes, research drugs). Therefore, a monopoly may be needed in this industry.

- A government may be able to regulate monopolies to gain benefits of economies of scale, without the disadvantages of higher prices.

How Monopolies can develop

- Horizontal Integration. Where two firms join at the same stage of production, e.g. two banks such as TSB and Lloyds

- Vertical Integration. Where a firm gains market power by controlling different stages of the production process. A good example is the oil industry, where the leading firms produce, refine and sell oil.

- Legal Monopoly. E.g. Royal Mail or Patents for producing a drug.

- Internal Expansion of a firm. Firms can increase market share by increasing their sales and possibly benefiting from economies of scale. For example, Google became a monopoly through dominating the search engine market.

- Being the First Firm e.g. Microsoft has created monopoly power by being the first firm.

Regulation of Monopolies

Governements can regulate monopolies through- Price capping RPI-X to limit price increases

- Prevent mergers

- Investigating abuse of monopoly power, e.g. collusion

Unit 2: GDP & Living Standards

This revision presentation provides an introduction to the concept of GDP as a

measure of economic growth and an indicator of the standard of living.

Related Questions:

Unit 2, January 2013, Q2

Related Questions:

Unit 2, January 2013, Q2

Unit 1 & Unit 4: Cost Benefit analysis of HS2

The HS2 debate seems to dominate the headlines at the moment, giving

transport economists plenty of material to support their learning of

cost-benefit analysis, government finance issues, externalities and modal

switch. For those looking for a quick 'for and against' summary, the BBC magazine does a

very good job trying to balance the argument here

The article is useful for AS students looking at market failure, but also Unit 4 students discussing Economic Development and infrastructure spending.

Related Questions:

Unit 1: January 2010, Question 10

Unit 4: June 2011, Q1 & June 2012, Q5

The article is useful for AS students looking at market failure, but also Unit 4 students discussing Economic Development and infrastructure spending.

Related Questions:

Unit 1: January 2010, Question 10

Unit 4: June 2011, Q1 & June 2012, Q5

Saturday, 21 September 2013

Unit 3: Monopolistic Competition

In case you didn't get it through my amazing teaching....here is a short clip explaining the theory in more detail:

Related questions:

Minicab taxi firms are best described by the model of monopolistic competition. Which

of the following will be true for such firms in long-run equilibrium?

Productive efficiency Profit Product

A Yes Supernormal Homogenous

B No Normal Differentiated

C Yes Normal Homogenous

D No Supernormal Differentiated

E Yes Normal Differentiated

Related questions:

Minicab taxi firms are best described by the model of monopolistic competition. Which

of the following will be true for such firms in long-run equilibrium?

Productive efficiency Profit Product

A Yes Supernormal Homogenous

B No Normal Differentiated

C Yes Normal Homogenous

D No Supernormal Differentiated

E Yes Normal Differentiated

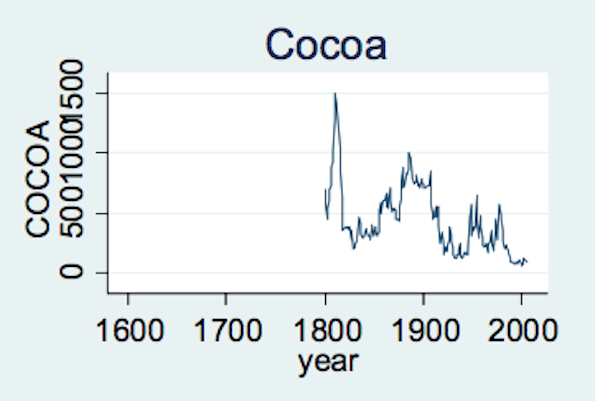

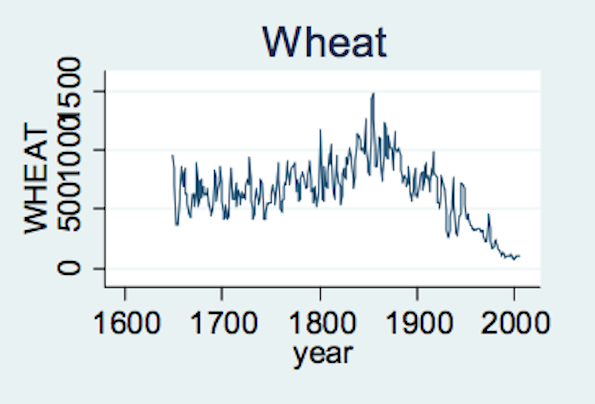

Unit 4: Prebisch-Singer Hypothesis & trade

Commodity price decline

A Marxist theory is (sort of) right

A new paper*

by the International Monetary Fund discusses the PSH. The authors examine 25

commodities, from sugar to silver, with some data going back to 1650. Since

1900, around 50% of the commodities show clear downward relative price slopes.

About 25% show a clear upward slope.

You will have to forgive the confusing

labelling of the graphs, but you get the idea:

These graphs show prices relative to manufactured

goods; in dollar terms many commodity prices have trended

upward over the past century. So countries that produce high levels of

primary products have, over time, done worse than economies which rely on

manufactured goods. The authors cautiously conclude that "in the majority of

cases the PSH is not rejected".

What can primary producers do about this?

In a recent conference at the IMF in Washington, one of the authors, Kaddour Hadri, suggested that commodity-dependent economies should take advantage of short periods of price spikes to invest in alternative industries. But many commodity-dependent economies fail to do this.

William Sawyer, of Texas Christian University, argues that South America has failed to take advantage of high commodity prices over the past decade. As a result, their economies are not well-equipped to deal with the current price declines.

But according to Javier Blas, a journalist for the Financial Times who spoke at the IMF conference, commodity producers have been fighting against the Prebisch-Singer hypothesis for the last century. Many have shifted production away from commodities which do relatively badly against manufactured goods. The development of the soybean market, as well as shifts towards farming of chicken and pork, are some examples of this. None of these commodities appears in the IMF paper, so it does not tell a complete story. Still, and oddly enough, the IMF seems to have turned up some evidence support a bit of Marxist economic theory.

Related exam questions:

Unit 4 June 10 - To what extent is primary product dependency a constraint on economic growth

and development in developing countries? (20 Marks)

Unit 4 June 11 - Assess the policies which might respond to rising commodity prices during a period of slow economic growth. (30 Marks)

Unit 3: Privatisation - The Post Office, a natural monopoly?

The coalition government has announced plans to privatise the Royal Mail by selling a majority stake in the business using an initial public offering (IPO) which could value it at more than £3 billion.

The business has had a long term struggle to become more efficient and profitable in recent years - it faces a number of significant competitive challenges from rival postal businesses and from new technologies and a decline in the volume of letters sent.

According to Business Secretary Vince Cable

"The government's decision on the sale is practical, it is logical, it is a commercial decision designed to put Royal Mail's future on a long-term sustainable business. It is consistent with developments elsewhere in Europe where privatized operators in Austria, Germany and Belgium produce profit margins far higher than the Royal Mail but have continued to provide high-quality and expanding services."

Trade union leaders oppose the plans fearing that a move to the private sector will cost jobs and that the commitment to a universal postal service will eventually end.

On or around the point of IPO, Government will transfer 10% of its shares in Royal Mail to an employee share scheme designed to boost incentives for those who work for the business.

Background on the Royal Mail:

- Ownership: The Royal Mail Group is currently a 100% Government-owned UK-wide company that was established as a separate ‘sister’ company to Post Office Limited on 1 April 2012

- Leadership: The current CEO is Moya Greene, a Canadian business woman

- Jobs: The Royal Mail has over 150,000 employees in the UK - a number of years of rationalisation has cut this figure by tens of thousands.

- Volumes: The rise of e-mail and the internet has led to a dramatic fall in the number of letters sent through the post via the Royal Mail

- Universal service requirement: The Royal Mail is required by law to provide a universal postal service - including delivery to any address throughout the UK six times per week, and a sufficient network of letter boxes and post offices

- Revenues: the Royal Mail has annual revenue of £9.3 billion of which just under half comes from letters, around £4 billion from parcels and the remainder from marketing mail services.

- Improving finances: Royal Mail Group has improved its financial performance considerably in recent years, the latest gross operating profit margin was 4,.4% although this is substantially less than businesses such as Deutsche Post which has achieved operating profit margins closer to 8%. Operating profits for the Royal Mail for the 52 weeks to the end of March 2013 jumped to £403m, up from £152m for the previous year

- Competition: The main rivals in the UK mail industry for the Royal Mail are Deutsche Post and TNT

- Parcels: The collection, sorting and delivery of letters has been a loss-making exercise for the Royal Mail for some years now but the parcels business is much more profitable helped by the rapid growth in online shopping. The government believes Royal Mail needs access to private sector capital to invest as it continues to change into a parcel-focused business.

- Prices of letters: In the last two years, the Royal Mail has been given more freedom by industry regulator OFCOM to decide on the price of a first class stamp, but with a cap set on the cost of a second class stamp at 55p. From 30 April 2012, the cost of a first class stamp for a letter was increased from 46p to 60p; the cost of a second class stamp for a letter increased from 36p to 50p

Liberalising the Market

The postal services market has been opened up to increasing competition in recent years with postal businesses able to apply for a licence to operate in competition to the Royal Mail. There are two main channels available to new competitors:

Access competition is where the operator collects mail from the customer, sorts it and then transports it to Royal Mail’s Inward Mail Centers, where it is handed over to Royal Mail, who are paid to deliver it. Nearly 40% of mail is now covered by access competition

End-to-end competition - where an operator other than Royal Mail undertakes the entire process of collecting, sorting and delivering mail to the intended recipients. Thus far few businesses have chosen to offer this. TNT Post began trialing end-to-end delivery operations in West London in April 2012

Related Examination question: Edexcel Unit 3 - Jan 09 Question 12

Labels:

natural monopolies,

post office,

privatisation

Subscribe to:

Comments (Atom)