I don't think anybody has any idea what the economic impact of Brexit will be. Steve Eisman

Total Pageviews

Wednesday 14 December 2016

Monday 28 November 2016

Theme 1: Government Failure & Public Goods

Two presentations that link government failure and the provision of public goods.

Labels:

Government Failure,

Public Goods,

quasi public goods

Sunday 27 November 2016

Thursday 24 November 2016

The Autumn Statement - Thoughts?

Click here to access the Autumn statement from the Chancellor. Makes for interesting reading...we will discuss in class (Politics & Economics)

Thursday 17 November 2016

Wednesday 16 November 2016

Theme 2 & 4: What is Frictional Unemployment?

Useful video explaining the concept of frictional unemployment. Helps to explain why an economy is unlikely to ever have 100% employment as there will always be some people in between work.

Saturday 12 November 2016

Theme 3 & 4: Consumerism hits China in a BIG way!

An interesting piece of marketing by Alibaba, the Chinese equivalent of Amazon....

Questions for discussion:

What does say about economic development in China?

How might this growth in consumer spending and middle class population, effect demand management in China?

What are the benefits/opportunities for the rest of the world?

Questions for discussion:

What does say about economic development in China?

How might this growth in consumer spending and middle class population, effect demand management in China?

What are the benefits/opportunities for the rest of the world?

Theme 4: Egypt gets loan from IMF

Click here to access a BBC article on how Egypt, with help from the IMF, intends to solve it's economic crisis. Lots of economics in the article, floating exchange rates, fiscal policy, economic development, FDI, supply side policy etc etc.

Click here to access a BBC article on how Egypt, with help from the IMF, intends to solve it's economic crisis. Lots of economics in the article, floating exchange rates, fiscal policy, economic development, FDI, supply side policy etc etc.Thursday 10 November 2016

Theme 1 & 3: How to answer short answer questions from the A level paper 1

Examiners require you to have three elements in your answers:

- Knowledge – this is usually identification of different points OR definitions of key theories.

- Application – you need to provide examples illustrating your economic theory OR identifying some facts from the information provided. Make sure that your examples are ALWAYS related to the examples used in the question.

- Analysis – here you need to refer to the impact or consequences of the theory you have discussed OR provide a benefit or cost of the theory discussed.

Here is an example to make you understand better what you are required to do:

Briefly explain the market structure in the grocery industry in the UK for the period shown. (5)

Knowledge – this market is an oligopoly, where a few large firms dominate the market.

Application – the 4 firm concentration ratio is 73.4%, showing that the 4 largest firms, Tesco, Asda, Sainsbury's and Morrisons control more that half of the market.

Analysis – As a result it can be inferred that the market is highly concentrated and there are likely to be high barriers to entry and exit from the industry.

Given the changes made in your A-level exams, you have to be extra careful when it comes to the structure of your answers. Make sure you do not miss any of the above stages, to ensure you score the highest of marks.

Wednesday 9 November 2016

Tuesday 8 November 2016

Theme 2 & 4: Egypt's currency falls by over 50%

In recent times, Egypt have switched between floating and fixed exchange rates for its currency - the pound. After the Arab Spring of 2011 it reimposed controls and only now has decided to revert to a floating exchange rate, with the effect that it fell 48% immediately and has continued to fall in subsequent days.

The key reason for the decision to move to a floating rate seems to be because they want a large loan ($12billion) from the IMF and won't get it without making the change! According to the IMF, "The flexible exchange rate regime... will improve Egypt's external competitiveness, support exports and tourism and attract foreign investment, all of this will help foster growth, job creation and stronger external position for the country."

Of course, the cost of imports will now increase significantly which will cause some short-term pain for Egyptian consumers and businesses that need to import machinery etc.

Students may themselves be thinking how all of this could affect them so it might be a good time to ask if a) anyone has been to Egypt (perhaps unlikely, depending on where you are) or b) anyone wants to go to Egypt at some point in their life. An interesting digression can then be made into why you might want to go to Egypt, what other "bucket list" items you might have and bringing it all back to the effect of exchange rates on the cost :)

The article can be found here.

Thursday 3 November 2016

Theme 3: Government regulation

Excellent presentation on the ways governments regulate industry, the reasons behind it, and the advantages and disadvantages of each method.

Labels:

government regulation,

rpi-x,

rpi+k,

target setting

Monday 31 October 2016

Theme 3: Ten Charts on Oligopoly and Business Economics

Your homework for this evening is to look at one of the charts from the presentation below and comment on how this would affect consumer welfare, and how the firms would compete.....

Slide 2 & 4 - Sam

Slide 3 - Iain

Slide 5 - Salmaan

Slide 6 - Aidan

Slide 7 - Keelan

Slide 8 - Tom

Slide 9 - Lewis

Slide 11 - Erika

Sunday 30 October 2016

Theme 1 & 3: The cost of a cuppa to go up!

Click here to access a BBC article on why the price of a cup of tea is going to go up! Demirhan, why is this happening?

There is lots here that relates to your micro papers. Costs of production, elasticities, weak pound, competition, normal profits.

Excellent article.

There is lots here that relates to your micro papers. Costs of production, elasticities, weak pound, competition, normal profits.

Excellent article.

Thursday 27 October 2016

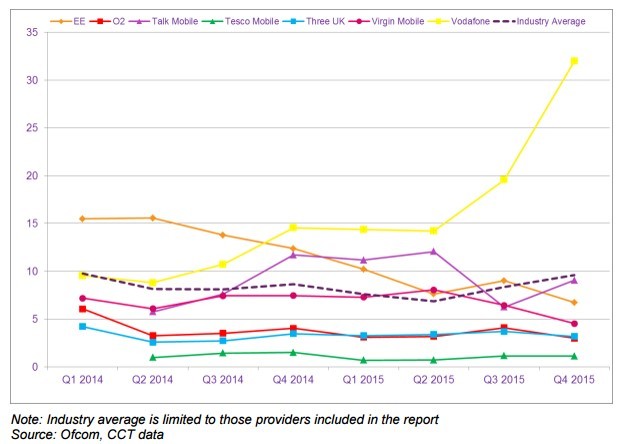

Theme 3: Vodafone fined for poor service!

Vodafone have been fined £4.6m by regulator Ofcom for what has been classified as 'serious' breaches of consumer protection rules. These breaches include failing to top up some accounts of Pay As You Go customers and failing to deal adequately with customer complaints. Complaint levels for Q4 of 2015 can be seen below. It does not paint a pretty picture for Vodafone!

This fine offers a different angle for students to consider in terms of the role of regulatory bodies. As well as keeping check on an industry in terms of its prices and scope of delivery, regulators like Ofcom also have a duty to ensure that the quality of service is satisfactory.

The analysis from the Sky News clip below makes a salient point that you students may like to use as an evaluative argument. The clip suggests that a £4.6m fine is a small amount for a firm that makes multi-billion pound profits and may not act as much of a deterrent either to Vodafone or their competitors.

Pay monthly mobile telephony complaints per 100,000 customers/connections: Q1 2014 - Q4 2015:

Wednesday 26 October 2016

Theme 3: Mergers, market power and efficiency

Nice article to read on the impact of takeovers and mergers on economic efficiency and consumer welfare.

Drawing on research on the US economy, a report finds that corporate integration accelerates the process towards oligopolistic markets which can lead to higher prices in the long run.

"Bruce Blonigen and Justin Pierce of the Federal Reserve Board have some evidence. In a new paper titled “Evidence for the Effects of Mergers on Market Power and Efficiency,” they look at how mergers in manufacturing affect corporate performance. What they discovered is that mergers usually tend to increase market power -- in other words, they allow companies to increase profits by hiking prices. But they don’t find much evidence for improved efficiency."

Salmaan, let the class know what you think!

Sunday 23 October 2016

Y12 Economists: Theme 1 - Indirect Taxation & Government Subsidies

Hello all,

just a heads up on this weeks lessons. We only have 3 this week, so I will go though some theory tomorrow (indrect taxes and subsidies), then rest of week, will be spent going through some long answer questions.

just a heads up on this weeks lessons. We only have 3 this week, so I will go though some theory tomorrow (indrect taxes and subsidies), then rest of week, will be spent going through some long answer questions.

All themes: The 6p a minute cafe

I love this idea!

I love this idea!Click here to access a very different business model. This is definitely thinking outside the box. Eamon, can you see any economic theory behind this model?

Theme 4: Ceta talks: EU hopes to unblock Canada trade deal

Click here to access an article about trade blocs, trade deals and the advantages/disadvantages for those involved.

Theme 3: AT & T to buy Time/Warner - integration

Click here to access an article discussing the latest major piece of business integration. For once, I actually find myself siding with Donald Trump!

Useful article when looking at horizontal/conglomerate integration. Specifically the potential advantages/disadvantages of the deal for consumers.

The companies say the deal will bring all sorts of good things for the consumer. However, many (including Trump) are suggesting it would make the company far too powerful.

What do you think...........Aruj?

Useful article when looking at horizontal/conglomerate integration. Specifically the potential advantages/disadvantages of the deal for consumers.

The companies say the deal will bring all sorts of good things for the consumer. However, many (including Trump) are suggesting it would make the company far too powerful.

What do you think...........Aruj?

Thursday 20 October 2016

Theme 1: Elasticity of Supply in action: Where has all the whisky gone?

An almost perfect example here of inelastic supply in action. By law, all Scotch whisky must be aged for a minimum of three years and it takes several years for new distilling capacity to come online.

Questions for Tammy to answer....

Why has the price of whisky gone up? (use a supply & demand diagram in your answer)

What does the article suggest about the elasticity of supply of malt whisky?

Questions for Tammy to answer....

Why has the price of whisky gone up? (use a supply & demand diagram in your answer)

What does the article suggest about the elasticity of supply of malt whisky?

Wednesday 19 October 2016

Theme 3: Netflix and reducing contestability of on line streaming

the video streaming market is one that could be classed as a good example of a highly contestable market. This is on the grounds that the market contains some of the characteristics of contestability such as relatively low sunk costs, low customer loyalty and the market has a highly credible risk of new firms entering.

In recent years, Netflix has become one of the world’s leading providers of video streaming. Concern that their growth was faltering has now reduced as new figures show that the number of new subscribers has increased by 3.2m worldwide between July and September 2016. One key to their growth, however, is the broadened use of their own programmes – many subscribers have shifted across to Netflix to consume their original content (House of Cards, Daredevil & Narcos to name but a few). The cost of such bespoke shows can be considerable and, as such, suggest that it may put off new entrants to the market who are unable to compete with the quality of shows or invest in production of original content when it has little guarantee of success. It could be argued that this level of development in the market is reducing the threat of new-firm entrants and making the market less contestable.

Here is a short news cast outlining recent announcements about Netflix’s success.

Tuesday 18 October 2016

Theme 2: Inflation is beginning to rise - Weak pound to blame

Evening everyone. I'm looking forward to Minsung explaining this article in tomorrows lesson! It is really useful to understand what is going on in the UK economy. This is macro economics, something we which will look at after xmas.

Evening everyone. I'm looking forward to Minsung explaining this article in tomorrows lesson! It is really useful to understand what is going on in the UK economy. This is macro economics, something we which will look at after xmas.However, always good to debate the issues in lessons.

Theme 2, 3 & 4: Will the pound's fall help the UK economy rise?

Larry Elliott's piece here in the Guardian looks at the implications of Brexit, both for the pound in the short-term and the whole economy in the longer term. He reiterates the view that the short-term implications of the weaker currency will change the emphasis within the UK economy.

However, as he points out, its longer term health is largely dependent upon the ability of the UK economy to adapt and adopt the structural reforms required to tackle its twin deficits. If we fail to do this, we've missed a genuine chance to rebalance the economy at a time which might permit seismic change.

Theme 1: Marmite - Love it or hate it?

Morning all,

Morning all,Marmite has been in the news recently, nothing to do with demand and everything to do with supply. Click here to read a 'History' of Marmite.

What does the article suggest about the elasticity of demand doe the product?

Also, regarding recent articles I have posted, what does this suggest about the elasticity of supply of Marmite!

I think todays winner is going to be............Rayshmi!

Sunday 16 October 2016

Theme 3 & 4: The depreciation of the pound and how it affects us all!

Click here to access many recent articles on the collapse of the pound sterling. This is having (and will have) a major impact on the UK economy and hence is extremely likely to be a question on your exam papers next summer!

Click here to access many recent articles on the collapse of the pound sterling. This is having (and will have) a major impact on the UK economy and hence is extremely likely to be a question on your exam papers next summer!We will look at this when we study currency movements after xmas, but please take some time to read some of the various articles. It would be great if you could come to class and discuss what you have read and even ask some questions.

All Themes: UK food prices going up - BREXIT being blamed

See below the article that discusses food price inflation in the UK. This has many links to economics. Supply and demand, elasticity, exchange rates, free trade, inflation to name but a few. I am going to stick a name in this piece, just to see if you are reading this stuff! So, Abi Christon......I'll let you explain the article next lesson!

See below the article that discusses food price inflation in the UK. This has many links to economics. Supply and demand, elasticity, exchange rates, free trade, inflation to name but a few. I am going to stick a name in this piece, just to see if you are reading this stuff! So, Abi Christon......I'll let you explain the article next lesson!Here’s Just How Much More Expensive Food Has Got Since The Brexit Vote

Butter up 58%. Sugar up 37%. Beef up 33%. Pork up 18%. Wheat up 17%. The list goes on…

Britain’s food producers are facing price hikes of more than 50% on some key ingredients since the UK voted to leave the EU, figures obtained by BuzzFeed News reveal.

This week, Unilever, the producer of brands including Marmite, PG Tips, and Lynx, had a public row with Tesco after Unilever sought price hikes of around 10%, blaming higher costs post-Brexit. Newspapers and commentators suggested the company, which backed Remain, may be trying to profiteer off the back of Brexit.

However, the data suggests the wholesale cost in sterling of many key foodstuffs has increased substantially since June. The new figures, produced by the data consultancy firm Mintec, compare the prices of key ingredients today to the day before the Brexit vote in June.

The Mintec figures suggest a tonne of New Zealand butter costs 58% more than it did in June, while sugar costs 37% more, beef is up 33%, pork is up 18%, and wheat is up 17%.

Mintec

This table shows the change since the EU referendum in the price of a selection of foodstuffs. The left-hand columns show the price changes in pound sterling, while the right-hand column shows the price change in the foodstuff’s native currency.

For everything except cocoa – which is traded in sterling – the UK has seen bigger price rises.

For everything except cocoa – which is traded in sterling – the UK has seen bigger price rises.

The key driver of many of the increased prices is the drop in the value of the pound, which has fallen around 17% since the day of the EU referendum.

These figures don’t mean prices on the supermarket shelf will go up this dramatically, or immediately. Food suppliers generally agree contracts with fixed prices for around six months or so, which delays the impact of price rises.

Consumer prices will also rise by less than this as ingredients are just one of many costs in the supply chain. However, within around a year or so price changes are passed to the consumer.

Helen Dickinson, CEO of the British Retail Consortium, which represents supermarkets and retailers, tacitly acknowledged in an emailed press release on Thursday that there is “inflationary” pressure in the food supply chain, and said retailers will not be able to absorb it.

“Retailers are firmly on the side of consumers in negotiating with suppliers and improving efficiencies in the supply chain to control the inflationary pressure that is building through the devaluation of the pound,” she said.

“However, years of falling shop prices and higher costs have left limited scope for retailers to continue absorbing this pressure, and everyone in the supply chain will need to play their part in maintaining low prices for consumers.”

A food supplier contacted by BuzzFeed News confirmed the pressure.

“The reality is that costs are increasing for every supplier,” he said. “Right now, every supplier is having a debate about what to do.”

Mintec noted that the food sector would be particularly affected by the weakened pound.

“For UK exporters, a weaker GBP is positive in the short term as it makes British products more competitive on the global market, driving higher demand,” it noted in a blog post.

“On the flip side, goods imported into the UK would be more expensive. Around 40% of all food consumed in the UK is imported, with over 70% of total food and drink imports from the EU.”

Saturday 15 October 2016

Theme 3: Tesco Vs Unilever (Monopsony Vs Monopoly)

In what has been dubbed the "Marmite War", Tesco has pulled many Unilever products from their online store over a dispute about raising prices. Products such as Marmite, Ben and Jerry's ice cream, Flora and Persil are no longer available because Unilever is pushing for 10 per cent price rises across the board to cover the rising costs of imports following the depreciation of sterling since June 2016.

A lower pound makes import prices more expensive in £s but Tesco is reluctant to raise their prices because of increasingly fierce competition with discount retailers such as Aldi and Lidl.

Retail profit margins have been squeezed over recent years and Aldi and Lidl have more products supplied under a private label and they source more of their processed foods from within the UK. They concentrate on fewer less well known brands at more competitive prices.

Which business will buckle first? Both Tesco and Unilever have significant market power and the likely outcome will likely be a trade-off between the two corporate giants. Price rises are inevitable when the exchange rate falls by more than 15% but not all of the (anglo-Dutch) Unilever's products sold in the UK are produced in overseas countries. Unilever's profit margins are also quite small. What we are seeing here is a battle for profitability across the supply chain.

Readers will be relieved to hear that I have managed by guarantee enough Marmite to last me for the next ten years by purchasing one jar from my local supermarket.

Thursday 13 October 2016

Theme 3: Tesco removes branded products from shelves

Click here to access a really interesting article on how firms are operating as a result of the fall in the value of the pound.

Could you draw a cost and revenue curve diagram, highlighting the potential issues facing Tesco and it's profits.

Can you also relate this to game theory and how an oligopolistic firm competes.

Could you draw a cost and revenue curve diagram, highlighting the potential issues facing Tesco and it's profits.

Can you also relate this to game theory and how an oligopolistic firm competes.

Labels:

brexit,

depreciation,

food inflation,

game theory,

tesco

Tuesday 11 October 2016

Theme 4: The synoptic paper - a presentation

This was a presentation from a recent INSET I attended. Still relevant for Y13 students about to tackle paper 3 for the fist time.

Sunday 9 October 2016

Thursday 6 October 2016

Theme 3: Oligopoly Presentation

Continuing from what we covered in the lesson, work your way up to slide 23 and have a look at collusion in your new textbooks.

Wednesday 5 October 2016

Theme 4: Globalisation - The elephant in the room!

I read an article today which highlights some of the issues surrounding globalisation and who has benefited the most from it. On Thursday, 6 October the BBC will be reporting from around the world on the impact of globalisation on people's lives and on the growing movement against free trade.

Click here to read the article.

There will be special coverage on TV, radio and online. Globalisation is the major topic for macro economics this year. So any article I post will be of great help for both paper 2 and paper 3.

Click here to read the article.

Tuesday 4 October 2016

Monday 3 October 2016

Them 3 - Exam question

(d) Examine the likely reasons Hanson chose to grow ‘through a number of mergers,

to become one of the world’s biggest companies’(Extract C lines 18 and 19). (8)

(e) Discuss the likely impact of the demerging of conglomerates on efficiency.(15)

Theme 1 & 3: North Korean Airline - Inferior Goods and how firms compete (or don't!)

Perhaps for those North Koreans permitted to fly Air Koryo on one of the few domestic flights or four international routes, a journey with the world's worst-rated airline might be a sign of luxurious privilege and political standing. But as this short video makes clear, life on board Air Koryo - consistently rated as the worst airline in the world - is pretty basic. In fact, it's the only airline with a one-star rating on airline-review site Skytrax. A useful clip when dicussing inferior goods (partly because the airline food looks so appetising) and how inefficient a local monopoly might be.

Sunday 2 October 2016

Theme 1 & 3: The problem with vertical, horizontal & conglomerate intergration

Click here to access an article which shows how a franchise used by Tesco employs Romanian workers at half the minimum wage.

Labels:

car wash,

franchise,

minimum wage,

romanian,

tesco

Thursday 29 September 2016

Theme 4: Economic Development - What next for China

Transcript Notes

The year is 2031, and China’s economy is defined by a wave of new medium and large sized firms that have replaced the old, inefficient State Owned Enterprises. This led to… middle class. How did they get here?

The private sector in China

Inefficient; half of private firms. More debt than private firms: 2005, both had DER of 1.3; 2013 0.8 for P, 1.6 for SOE. Debt:GDP 260%, 115% of which is SOEs. However, in 2012 was only 100%. From 2006-2016, share of profits by SOEs has halved. Response: lighter touch model (like Singapore) in 2015; encouraged growth of new private firms to take over SOEs.

A new reserve currency?

Renminbi to be a WRC, indicated by 1) Petrodollar demand drops as Reuters, Deloitte and BP predict US becomes oil self-sufficient by 2035; FT ran 2015 piece on how China overtook US importing oil, trend continues in future. China deliberately securing use of renminbi in trading oil: 2012 – Iranian diplomats confirm China buying crude oil in Yuan. PBOC and UAE Central Bank perform $5.5bn currency swap, setting stage for Abu Dhabi settling oil sales to China in yuan.

2) China taking advantage of IMF’s Special Drawing Rights. August 2015, World Bank issued 500 million 3-year SDR bonds to selection of 50 banks, brokerages and insurers in China; director general of PBOC Zhu Jun says bonds will attract official investors and then private sector. China Construction Bank Corp. predicted that in the years following, SDR bonds would swell to $7bn across nation. Renminbi included in SDR basket as of October 2016: central banks holding SDRs all over the world exposed to renminbi overnight, gains official reserve currency status quickly

Why advantageous to the Chinese private sector? Reduction in regulations surrounding capital flows + SDR bonds = businesses can venture outside China more easily Better capital account convertibility + more open capital market = financing needs met easily (according to Holdings Plc chief China economist Qu Hongbin.

But might a stronger currency threaten low-value added Chinese exports? Not an issue, as changes to the manufacturing sector are forcing China to switch to high value-added.

China reaches a Lewis Turning Point

Lewis turning point (IMF forecast this by early 2020s). Cost of labour rising since 2000 by 20% per year. Cost of capital rising 4.3% per year between 2000-2010. Between 1990-2005 China needed $3.4 capital for $1 GDP – by 2005-2015, this was $5.4 – by 2025 (IGM predicted the figure would be) $7.6. Trend was already evident in 2016: some heavily capital-reliant industries required .96c in China for every dollar in US. Therefore cost advantages of producing in China disappeared.

Solution is innovation: new business models (such as Xiaomi increasing the lifespan of phones to 24 months to benefit from greater economies of scale and reduce cost of researching new components), higher quality products that fit into different market tier. Already in 2016: R&D jumped from 43% of US’ R&D in 2012 to nearly 60 in 2016.

This growth of the private sector responsible for other changes: fuels ballooning middle class, higher incomes and also attracts FDI to China alongside educated foreign workers to meet the demand created by Chinese firms (15 years not enough time to re-educate entire generation of Chinese students).

FINANCIAL INSTABILITY

China also had to tackle financial instability in the peer-to-peer lending sector before 2031. The industry started around 2013 and grew tenfold in the next couple of years to account for 0.5% of Chinese lending, though it was rife with fraud, scams and malpractice circa 2014-16. The best example of this was Ezubao, the largest peer-to-peer lending group in 2015 which turned out to be a Ponzi scheme, costing 900,000 investors the equivalent of US$7.2 billion.

What did the government do to stop this issue?

What happened was that stricter Chinese regulation of the sector from around 2017 onwards, which included the setting up of a regulatory authority for peer-to-peer lenders and increased penalties for those engaging in malpractice, not only helped to rid the sector of most issues but also aided China’s growth as small firms and individuals were more able to gain financing as a result of Chinese lenders increased trust in the system. Because of this, the value of the shadow banking industry (which was estimated at 45 trillion yuan in 2016) has grown at a far slower rate than the Chinese banking industry as a whole, though estimates of its true size are likely to be unreliable.

China also had to cope with financial instability caused by the prevalence of non-performing loans, or NPLs. In 2016 the proportion of NPLs as a total of all Chinese loans was very hard to establish; back in the days before Chinese figures were reliable, official statistics stated that NPLs formed 2.15% of Chinese commercial bank loans, although most independent estimates placed them at around 10% and Kenneth Rogoff famously said that ‘no serious person thinks it’s below 7-8%’. These statistics were even harder to estimate given the fact that the definitions of NPLs varied widely between China and the West, the fact many bad loans that would be NPLs elsewhere were classed as being in ‘special measures’ under the Chinese system, and the fact that Chinese NPL prevalence only included the banking system and not those loans held by Asset Management Companies or other trusts. In 2022, after the proportion of non-performing loans to total Chinese loans increased to a widespread belief of around 20%, stock markets in China became increasingly volatile, eventually encouraging the Communist Party to ditch its strategy of doing nothing and letting all the bad debt roll over, and solve the issue.

What was the solution to this?

This took the form of a debt resolution act in the early 2020s, which relaxed Chinese restrictions on debt/equity swaps and encouraged banks to make use of them to regain capital due on any outstanding non-performing loans (given the valuation of the companies as valued by the newly-created Debt Management Agency). The resolution also gave banks greater power to seize assets to repay NPLs and reduced the time required to solve NPL disputes in the Chinese court system; the former increased inequality and poverty slightly in the short-term but eventually led to far higher levels of investment in Chinese businesses and subsequently lowered unemployment. China’s making the renminbi a world reserve currency also led to major increases in Chinese capital markets and foreign investment, and increased the proportion of Chinese debt held abroad from 5% to 35%, although (as in the past) there remain some complaints from foreigners of courts being biased in favour of domestic firms in loan disputes. Nonetheless increased foreign investment led to the spreading of NPL ownership around the world, reducing the impacts of default on the Chinese economy whenever defaults did occur (though NPLs currently stand at around merely 3% of Chinese loans).

In the news

The story of China different to story you will see in the news. If our predictions on China are right, expect these stories to develop as they are the steps China will take to protect and nurture its new private sector and world reserve currency status.

Corruption rid of to 1) aid credit flows to Chinese businesses 2) encourage investment in such firms by making them more reliable. Example of Xi Jingping.

Petroyuan recycling: cities in Nigeria, Iran like Dubai (especially given China’s fondness of designing and building entire cities from scratch). Benefits of such recycling: petrodollar used to purchase dollar-denominated assets such as treasury bills which ensure financial liquidity, keep interest rates low and promote non-inflationary growth – expect China to be afforded the same luxury.

Tuesday 27 September 2016

All Economists - University Rankings

One common question from students at this time of year is about recommendations for which university they should apply for. Students, of course, should think about many factors including proximity to home, relative cost of study, relative cost of living and the type of course they wish to undertake. Economics is a common subject to be delivered around the country but each institution will place its own spin with varying degrees of concentration on the individual topics within the core content. In particular, students should look carefully about the numerical content of the course and ask themselves if that matches their requirements and/or skills.

For a student that may be aiming high or looking for some guidance, they could do a lot worse than consider the 'Complete University' guide on where to attend. The guide uses criteria such as entry standards, research reputation, student satisfaction and job prospects to rank universities. Likewise, students may wish to consider the Times Higher Education World University Rankings if they are setting their sights a little wider.

The list below shows the 'Complete University' guide's top 10 and gives a little detail on each, as attained from the university's own publicity. The number in brackets is last year's rankings.

1

|

Cambridge University (1)

|

The Faculty of Economics at Cambridge has roots going back to the 1890s. Though frequently marked in the past by fervent internal academic debate, over theory, ontological approach and methodological orientation, the cumulative contribution of Cambridge economics to the development and evolution of the discipline nationally and internationally has been profound and unique. Cambridge has repeatedly attracted international recognition and distinction by spawning some of the leading economics thinkers and paradigm changers of the times, including, for example, Alfred Marshall (one of the founders of Neoclassical economics), John Maynard Keynes (his general theory of employment, interest and money), Joan Robinson (capital theory), Richard Kahn (multiplier theory), James Meade (international economics), Nicholas Kaldor (increasing returns and economic growth), James Mirrlees (taxation), and Partha Dasguta (poverty and environmental economics). During the 1970s, the ‘Cambridge School of Post-Keynesian Economics’ was a frequently used term to describe the distinctiveness of the research undertaken in the Faculty. The Faculty can boast several Nobel Prize winners over the past century.

| |

2

|

Oxford (3)

|

Oxford's department of Economics is one of Europe's leading research departments and its members include some of the world's most distinguished academic economists. Amongst the current faculty, 14 are Fellows of the British Academy, 4 are Foreign Honorary Members of the American Academy of Arts and Sciences, 13 are Fellows of the Econometric Society and 7 are Fellows of the European Economics Association. Six Nobel prize winners in Economics – Sir John Hicks, Lawrence Klein, Sir James Meade, Sir James Mirrlees, Amartya Sen and Joe Stiglitz – are former members of the department. In the most recent UK Research Assessment, Oxford Economics had more research output graded as world-leading in terms of its originality, rigour and significance than did any other economics department in the United Kingdom.

| |

3

|

Warwick (2)

|

The Department of Economics was one of the original departments of the University of Warwick when it was opened in 1965. Since its founding, the Department has become one of the largest departments in the discipline and is now widely regarded as one of the top Economics departments also across Europe. The Department has an academic staff of around 90, including 25 professors. It has approximately 1,200 undergraduate students and 300 postgraduates.

Both economics research and teaching emphasise modern economic analysis and quantitative methods. These have been key underpinnings of the work of the Department since its inception.

| |

4

|

University College London (5)

|

The appointment of John Ramsey McCulloch to the chair of Political Economy at UCL in 1828, supported by funds raised in memory of David Ricardo, established the first Department of Economics in England. Jeremy Bentham was a major intellectual influence on the founders of UCL and Joseph Hume was a member of its original council. Two years later Say himself was appointed to the first Chair of Political Economy in France at the College de France in Paris.

The department of Economics has an outstanding international reputation in key areas of current research. It is the only department of economics in the UK to have received the outstanding grade-point average of 3.78 (out of 4) in the 2014 REFwith 79% of all indicators of output rated at the highest 4* level.

| |

5

|

London School of Economics (4)

|

The LSE Department of Economics is one of the biggest in the world, with expertise across the full spectrum of mainstream economics. A long-standing commitment to remaining at the cutting edge of developments in the field has ensured the lasting impact of its work on the discipline as a whole. Almost every major intellectual development within Economics over the past fifty years has had input from members of the department, which counts ten Nobel Prize winners among its current and former staff and students. Our alumni are employed in a wide range of national and international organisations, in government, international institutions, business and finance.

| |

6

|

St Andrews (13)

|

The School of Economics & Finance is consistently ranked the top Economics School in Scotland. Their research was highly rated in the most recent Research Assessment Exercise (RAE 2008) with 55% of our research rated as ‘world leading’ or ‘internationally excellent’. They have a structured and rigorous foundation of economic concepts, principles, analysis, techniques and knowledge. Their strengths include applied theory, dynamic macroeconomics, finance, household economics, competition, innovation and climate change.

| |

7

|

Durham (7)

|

Durham a world class reputation for research and teaching; our research is broad ranging and far reaching and includes theoretical and applied economics, economic growth and policy, behavioural economics and finance, and accounting. Courses concentrate on the fundamental theories and techniques to help you build a successful career in this competitive field. Taking in historic and current, domestic and international perspectives.

| |

8

|

Bath (6)

|

The Department has a strong international research reputation in mainstream economics. The University campus is compact, safe and vibrant with world class sports facilities. The campus is situated 2km from the centre of the beautiful historic city of Bath.

| |

9

|

Nottingham (9)

|

The School of Economics at The University of Nottingham is a recognised global leader in its field.

High-quality research feeds into its teaching; they were ranked 6th among the UK's economics departments for research power by the Research Excellence Framework 2014 with research acknowledged as among the most significant of its kind anywhere in the world.

| |

10

|

Exeter (10)

|

Some aspects of Economics courses at Exeter:

|

Sunday 25 September 2016

Wednesday 21 September 2016

Theme 1 & 3: US farmers and organic produce

Some elementary microeconomics here: certain farmers in the US are promoting the sale of 'natural' (i.e. hormone free) meat. This means that they've reduced the head of cattle they farm but are still able to make a profit. It's clear why this is the case: there's a demand for 'organic' foodstuffs in the developed world and it's likely to be a luxury good and have a more price inelastic demand curve.

Final year economists should be able to identify two reasons why this is the case - think in terms of consumer incomes and the attitudes of organic consumers. If this is the case, then the premium price they are able to charge more than offsets the fact that the cattle are 5% more expensive to rear.

Subscribe to:

Posts (Atom)