See below for some old Unit 6 essay questions. The Unit 4 essay questions are exactly the same style and mark scheme, they are just marked out of 20 & 30.

Take a look at them and try and think of how the questions would differ if written today. For example, many of these were written well before the financial crash, when economies around the world were booming......therefore the objectives would be different (reducing inflation rather than encouraging growth for example)

I don't think anybody has any idea what the economic impact of Brexit will be. Steve Eisman

Total Pageviews

Wednesday, 29 May 2013

Unit 4: Practice Essay Questions

Unit 4 Essay Questions (Part b only)

You will all be completing one of these in the lesson today - it would be useful if, over the next two weeks, you attempt them all (there is only globalisation missing from this list - I am assuming you are happy with this area)

In several countries there has been increasing pressure for protectionist policies. Evaluate the likely economic implications of an increase in protectionism by the EU. (30 Marks)

Evaluate the likely economic effects of a decision by the UK to withdraw from the EU. (30 Marks)

Assess the effectiveness of supply side & fiscal policies to create economic growth and reduce unemployment in a country of your choice. (30 Marks)

Assess the economic effects of a significant increase in tax on the UK economy. (30 Marks)

Evaluate the factors which could improve the international competitiveness of UK’s goods & services. (30 Marks)

Assess the economic impact of prolonged austerity policies within the EU. (30 Marks)

Evaluate the economic effects of a significant fall in the value of the Euro against sterling. (30 Marks)

Evaluate four ways in which economic growth and development might be promoted in developing countries. (30 Marks)

To what extent is reducing the number of people living in absolute poverty sufficient to achieve economic development? (30 Marks)

Evaluate the economic effects of an increase in foreign direct investment on a country of your choice. (30 Marks)

Evaluate the economic effects of a significant rise in the value of the Chinese Yuan on the world economy.(30 Marks)

You will all be completing one of these in the lesson today - it would be useful if, over the next two weeks, you attempt them all (there is only globalisation missing from this list - I am assuming you are happy with this area)

In several countries there has been increasing pressure for protectionist policies. Evaluate the likely economic implications of an increase in protectionism by the EU. (30 Marks)

Evaluate the likely economic effects of a decision by the UK to withdraw from the EU. (30 Marks)

Assess the effectiveness of supply side & fiscal policies to create economic growth and reduce unemployment in a country of your choice. (30 Marks)

Assess the economic effects of a significant increase in tax on the UK economy. (30 Marks)

Evaluate the factors which could improve the international competitiveness of UK’s goods & services. (30 Marks)

Assess the economic impact of prolonged austerity policies within the EU. (30 Marks)

Evaluate the economic effects of a significant fall in the value of the Euro against sterling. (30 Marks)

Evaluate four ways in which economic growth and development might be promoted in developing countries. (30 Marks)

To what extent is reducing the number of people living in absolute poverty sufficient to achieve economic development? (30 Marks)

Evaluate the economic effects of an increase in foreign direct investment on a country of your choice. (30 Marks)

Evaluate the economic effects of a significant rise in the value of the Chinese Yuan on the world economy.(30 Marks)

Tuesday, 28 May 2013

Unit 4: Tariffs and trade

Click here to access an article on EU tariffs. This is a timely reminder that protectionism is once again on the agenda as the EU (and other trade blocs) fight to maintain market share in a recession hit world economy.

The article highlights the issues regarding tariffs as a specific protectionist tool. Trade blocs are open to retaliation, there are many advantages, but also consequences for such a policy.

Excellent application marks for any question on this topic.

The article highlights the issues regarding tariffs as a specific protectionist tool. Trade blocs are open to retaliation, there are many advantages, but also consequences for such a policy.

Excellent application marks for any question on this topic.

Monday, 27 May 2013

Unit 4: Past question

Better late than never. Apologies for the wait. However, this is a possible question, given the recession EU has been in recently....Mark scheme tomorrow......

(a) The number and size of trading blocs, such as the European Union, have increased in recent years. To what extent does this trend conflict with the aims of the World Trade Organisation? (20)

(b) In several countries there has been increasing pressure for protectionist policies. Evaluate the likely economic effects of an increase in protectionism by the EU. (30)

(a) The number and size of trading blocs, such as the European Union, have increased in recent years. To what extent does this trend conflict with the aims of the World Trade Organisation? (20)

(b) In several countries there has been increasing pressure for protectionist policies. Evaluate the likely economic effects of an increase in protectionism by the EU. (30)

Unit 4: Development - Should we cancel the debt ?

A recent article from the BBC highlights whu cancelling African debt can benefit both parties invoolved. A useful piece, which you could use when evaluation debt cancellation as a development policy.

In May 2013, the Brazilian government announced that it plans to cancel or restructure almost $900m in debt owed by African countries. The move is designed mainly to expand Brazil's economic ties with Africa and fast forward the growth of trade and investment between emerging countries and regions. In the aftermath of this move, Brazil’s future aid assistance is likely to target infrastructure, agriculture and social programmes. Among the 12 countries set to benefit are Tanzania, oil-producing Republic of Congo and copper-rich Zambia. The Southern Silk Road continues to develop as new models of aid and trade are forged between the emerging fast growing countries of the world.

Click here to access the full article.

In May 2013, the Brazilian government announced that it plans to cancel or restructure almost $900m in debt owed by African countries. The move is designed mainly to expand Brazil's economic ties with Africa and fast forward the growth of trade and investment between emerging countries and regions. In the aftermath of this move, Brazil’s future aid assistance is likely to target infrastructure, agriculture and social programmes. Among the 12 countries set to benefit are Tanzania, oil-producing Republic of Congo and copper-rich Zambia. The Southern Silk Road continues to develop as new models of aid and trade are forged between the emerging fast growing countries of the world.

Click here to access the full article.

Thursday, 23 May 2013

Unit 4: Essay on De-Globalisation

De-Globalisation has been a feature of global economics for the last five years. Here is a possible essay question on the topic.

a) Assess the main reasons why interdependence between countries has declined in the last 5 years. (20 Marks)

b) Examine the macroeconomic impact faced by a developed and a developing country of this de-globalisation trend. (30 Marks)

a) Assess the main reasons why interdependence between countries has declined in the last 5 years. (20 Marks)

b) Examine the macroeconomic impact faced by a developed and a developing country of this de-globalisation trend. (30 Marks)

Unit 4: Economic Development in Indonesia

Should Indonesia be added to the BRICS? Or will infrastructure issues slow it down the pace of economic development?

Here is a video report from the fast-growing country of Indonesia where infrastructure deficiencies threaten their sustainable growth rate.

"From outdated, overcapacity ports to stalled road and rail projects, Indonesia's infrastructure is in a sorry state. The resulting traffic jams and transportation delays affect everyone from local commuters to international investors. The government has grand designs to build new roads, airports and metro systems but endemic corruption and red tape stand in the way. Indonesia will have to up its game if it is to fulfill its potential as on of the world's hottest emerging markets."

Boom time for the Indonesian economy

Here is a video report from the fast-growing country of Indonesia where infrastructure deficiencies threaten their sustainable growth rate.

"From outdated, overcapacity ports to stalled road and rail projects, Indonesia's infrastructure is in a sorry state. The resulting traffic jams and transportation delays affect everyone from local commuters to international investors. The government has grand designs to build new roads, airports and metro systems but endemic corruption and red tape stand in the way. Indonesia will have to up its game if it is to fulfill its potential as on of the world's hottest emerging markets."

Boom time for the Indonesian economy

Unit 4: Globalisation and competitiveness

I saw this on Al Jazeera this morning. A good example of how globalisation in times of recession can affect demand for quality produce.

For centuries the Amalfi coastline in the south-west of Italy has been famous for its delicious lemons which are grown in small family-run farms, but traditional businesses like this are being squeezed by the economic crisis.

A report presented to Italy's parliament reveals just how much the country has been affected by the economic slowdown.

Small businesses are also reeling from foreign competition and globalisation, and are now looking for ways to control high production cost and protect their profit.

Questions for debate:

How could the Lemon growers of Italy compete with overseas lemons?

How could Italian government/EU help the growers?

What issues would either of the above have for the economies of the world.

For centuries the Amalfi coastline in the south-west of Italy has been famous for its delicious lemons which are grown in small family-run farms, but traditional businesses like this are being squeezed by the economic crisis.

A report presented to Italy's parliament reveals just how much the country has been affected by the economic slowdown.

Small businesses are also reeling from foreign competition and globalisation, and are now looking for ways to control high production cost and protect their profit.

Questions for debate:

How could the Lemon growers of Italy compete with overseas lemons?

How could Italian government/EU help the growers?

What issues would either of the above have for the economies of the world.

Unit 4: Not quite Trade Unions in UAE

Perhaps evidence of how free markets can discriminate against workers!

Dubai workers hold rare strike for more wages - Middle East - Al Jazeera English

Dubai workers hold rare strike for more wages - Middle East - Al Jazeera English

Tuesday, 21 May 2013

Unit 4: Foreign aid benefits Ethiopia

Thank you to Amba for finding this article on how foreign aid can improve development in Africa.

Excellent application and analysis for any question on economic development!

The African Union is celebrating its 50th anniversary and leaders from all over the continent are gathering in Ethiopia.

A country that was once known for its famines and international donations, Ethiopia is now showing some of the fastest growth rates in the world.

Unit 4: Factors affecting Globalisation

This is such a common theme in Unit 4 that I thought I would point out the main factors that have affected Globalisation (have I missed any). They are not in any particular order of importance. In fact, it would be interesting to see your point of view on what has been the most important (Essential for evaluation marks).

- Growth of Free Trade

- WTO

- Collapse of Communism

- Asian Tigers

- BRICS

- Improved ease of communication

- Transport costs

- Comparative advantage

- Trading Blocs

- Technological progress

- Growth of developing countries

- Containers (Please read article below - thank you Gabriele)

Containerisation is a testament to the power of process innovation. In the 1950s the world’s ports still did business much as they had for centuries. When ships moored, hordes of longshoremen unloaded “break bulk” cargo crammed into the hold. They then squeezed outbound cargo in as efficiently as possible in a game of maritime Tetris. The process was expensive and slow; most ships spent much more time tied up than plying the seas. And theft was rampant: a dock worker was said to earn “$20 a day and all the Scotch you could carry home.”

Containerisation changed everything. It was the brainchild of Malcom McLean, an American trucking magnate. He reckoned that big savings could be had by packing goods in uniform containers that could easily be moved between lorry and ship. When he tallied the costs from the inaugural journey of his first prototype container ship in 1956, he found that they came in at just $0.16 per tonne to load—compared with $5.83 per tonne for loose cargo on a standard ship. Containerisation quickly conquered the world: between 1966 and 1983 the share of countries with container ports rose from about 1% to nearly 90%, coinciding with a take-off in global trade (see chart above).

The container’s transformative power seems obvious, but it is “impossible to quantify”, in the words of Marc Levinson, author of a history of “the box” (and a former journalist at The Economist). Indeed, containerisation could merely have been a response to tumbling tariffs. It coincided with radical reductions in global trade barriers, the result of European integration and the work of the General Agreement on Tariffs and Trade (GATT), the predecessor of the World Trade

Yet a new paper aims to separate one effect from the other. Zouheir El-Sahli, of Lund University, and Daniel Bernhofen and Richard Kneller, of the University of Nottingham, looked at 157 countries from 1962 to 1990. They created a set of variables which “switch on” when a country or pair of trading partners starts using containers via ship or rail (landlocked economies, such as Austria, often joined the container age by moving containers via rail to ports in neighbouring countries, such as Hamburg in Germany). The researchers then estimated the effect of these variables on trade.

The results are striking. In a set of 22 industrialised countries containerisation explains a 320% rise in bilateral trade over the first five years after adoption and 790% over 20 years. By comparison, a bilateral free-trade agreement raises trade by 45% over 20 years and GATT membership adds 285%.

To tackle the sticky question of what is causing what, the authors check whether their variables can predict trade flows in years before container shipping is actually adopted. (If the fact that a country eventually adopts containers predicts growth in its trade in years before that adoption actually occurred, that would be evidence that the “container” jump in trade was actually down to some other pre-existing trend.) But they do not, the authors say, providing strong evidence that containerisation caused the estimated surge in trade.

What explains the outsize effect of containers? Reduced costs alone cannot. Though containers brought some early savings, shipping rates did not drop very much after their introduction. In a 2007 paper David Hummels, an economist at Purdue University, found that ocean-shipping charges varied little from 1952 to 1970—and then rose with the cost of oil.

Put them in a container

More important than costs are knock-on effects on efficiency. In 1965 dock labour could move only 1.7 tonnes per hour onto a cargo ship; five years later a container crew could load 30 tonnes per hour (see table). This allowed freight lines to use bigger ships and still slash the time spent in port. The journey time from door to door fell by half and became more consistent. The container also upended a rigid labour force. Falling labour demand reduced dockworkers’ bargaining power and cut the number of strikes. And because containers could be packed and sealed at the factory, losses to theft (and insurance rates) plummeted.

Over time all this reshaped global trade. Ports became bigger and their number smaller. More types of goods could be traded economically. Speed and reliability of shipping enabled just-in-time production, which in turn allowed firms to grow leaner and more responsive to markets as even distant suppliers could now provide wares quickly and on schedule. International supply chains also grew more intricate and inclusive. This helped accelerate industrialisation in emerging economies such as China, according to Richard Baldwin, an economist at the Graduate Institute of Geneva. Trade links enabled developing economies simply to join existing supply chains rather than build an entire industry from the ground up. But for those connections, the Chinese miracle might have been much less miraculous.

Not only has the container been more important than past trade negotiations—its lessons ought also to focus minds at future talks. When governments meet at the WTO’s December conference in Bali they should make a special effort in what is called “trade facilitation”—efforts to boost efficiency at customs through regulatory harmonisation and better infrastructure. By some estimates, a 50% improvement in these areas could mean benefits as big as the elimination of all remaining tariffs. This would not be a glamorous outcome, but the big ones seldom are.

Sunday, 19 May 2013

Unit 4: Flexible Working Hours - Who benefits the most?

From the employer's point of view, a zero hours contract is a great example of the benefits of the flexible labour market. They allow the employer to change the number of hours an employee works each week, with more shifts offered when they are busy, and fewer when they are not; costs can therefore be controlled and matched more exactly to revenue.

Neil Carberry at the CBI says that they have helped to save jobs during the recession and stagnant growth:

"It's zero hours contracts and other forms of flexible working that mean there are half a million fewer unemployed people than there might otherwise have been."

Now figures from the Office of National Statistics (ONS) show the number of 16 to 24-year-olds on zero hours contracts has more than doubled since the start of the economic downturn, rising from 35,000 in 2008 to 76,000 in 2012. This means that one in every three people on a zero-hours contract is under 25 (- although that proportion doesn't look as if it has changed very dramatically throughout the period shown).

If this is good for the employer, how is it for the employee?

That depends on their circumstances. Some are only seeking part-time work either because they are studying, or in order to fit around childcare arrangements, and for them the flexible contracts work pretty well.

However for others, who have regular outgoings of rent and household expenses to meet, the uncertainty and irregular income can create a real difficulty. Most of the jobs offered this way are with employers such as the fast food outlets like McDonalds and Subway, and high street chains like Boots and Sports Direct.

As the graph above shows there seems to be a seasonal pattern to them, with higher numbers at the end of most years than in April- June, and a particularly significant rise in the total number of zero-hours contracts in the fourth quarter of 2012 to over 200,000.

They seem to be a way of employers managing to deal with the difficulties of prolonged slow growth and lack of confidence, and raise the question of whether a job with uncertain hours is better than no job at all.

Tuesday, 14 May 2013

Unit 2: Possible Exam Questions

Could you answer these exam questions??

- Has Fiscal Policy been effective in reducing the deficit?

- Have Supply Side Policies been effective in reducing youth unemployment or increasing GDP?

- Evaluate the effectiveness of quantitative easing

- Using an appropriate diagram, explain why a fall in the exchange rate is likely to

- increase inflation.

- Assess the view that the use of interest rates is the best way to control inflation in the UK.

- Explain why cuts in public expenditure are likely to reduce aggregate demand

- Assess the likely impact of substantial cuts in public expenditure on the performance of the UK economy.

Unit 2: Assess the effectiveness of Monetary Policy..

This question from the Jan 2013 paper 'threw' a lot of you.

Firstly you need to think about what are the aims of the Monetary Policy Committee?

- keep inflation low (inflation target of 2%)

- maintain positive economic growth (close to long run trend rate of 2.5%)

- aim for full employment

Then you need to think about whether Monetary Policy Committee has been effective at meeting these targets.

Has the price level been stable? Has it been at 2%? Why, why not?

Has economic growth been stable?

Have the low interest rates worked?

Has quantitative easing worked?

To evaluate think about the causes of inflation; cost push and demand pull. Is monetary policy effective on cost push inflation?

Interest rates and QE have done little in a weak economic climate

But, what would GDP look like without these measures?

Monday, 13 May 2013

Unit 4: The EU - In or Out?

Click here to access an excellent article from the BBC on the advantages and disadvantages of staying in the EU. Really excellent for analysis and evaluation. A must read!

Sunday, 12 May 2013

Unit 4: Should Britain leave the EU?

Michael Gove says he would vote to leave the EU if there was a referendum tomorrow. Click here to access the article.

It raises interesting questions. Would the UK be better off out?

Do the economic advantages outweigh the disadvantages?

Thoughts?

It raises interesting questions. Would the UK be better off out?

Do the economic advantages outweigh the disadvantages?

Thoughts?

Unit 4: Investment in the Developing World

I never thought I would say this, but thanks to James Edwards for this article on the issues with investment in Africa.

Monday, 6 May 2013

Unit 4: The State of World Poverty - and it’s not all bad!

Useful resource for A2 students of Unit 4 found here produced by the World Bank looking to add to their background knowledge plus links to globalization and its benefits. According to the report, extreme poverty is on the wane globally:

Perhaps all the more astonishing given the 59% increase in the developing world's population!

How many reasons can you come up with for this dramatic decrease in extreme poverty?

Perhaps all the more astonishing given the 59% increase in the developing world's population!

How many reasons can you come up with for this dramatic decrease in extreme poverty?

Unit 2 and Unit 4: Impact of Austerity

This is not a scene from a country at war.

The Jan 2013 paper was all about the impact of austerity measures given weak economic growth. As the case study highlighted there have been job cuts in the public sector and cuts in other areas of public spending such as education.

To say that the impact of public sector job cuts is solely unemployment is not enough! What is the impact of unemployment?! Lower living standards, further falls in consumer confidence, negative multiplier etc.

The UK is not alone in implementing austerity... Portugal, Greece, Spain... All have seen job cuts. What is the impact? Public anger, strikes and even violence.. Trade Unions are much stronger in continental Europe which is why perhaps the reaction has been stronger. Could this happen in the UK? When you are writing answers to these 30 mark questions context is important. What has happened in the real world. Not just your text book.

Sunday, 5 May 2013

Unit 2: Output Gap

The output gap is the difference between the actual level of output and the potential level of output.

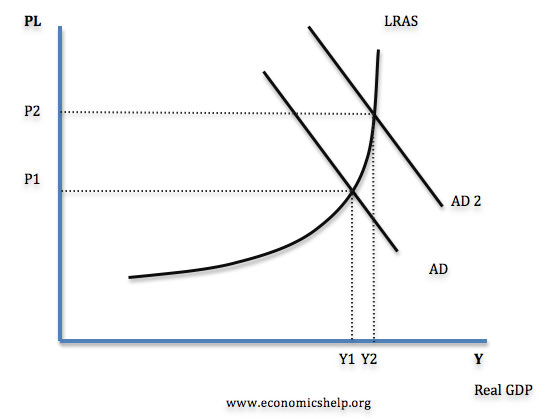

If you look at the above graph, the potential level of output is Y2. We know that this is full capacity as at Y2 the LRAS is inelastic indicating no spare resources.

In the above graph the actual level of output is Y1; We have a negative output gap! The output gap is the difference between potential and actual output (Y2-Y1)

What are the consequences of an output gap?

Well, firstly there is downward pressure on the price level as indicated by the fall from P2 to P1. This could potentially be a good thing as it could improve international competitiveness.

The second most obvious impact is a fall in employment as illustrated by the move from Y1 - Y2. More unemployment means that there is excess supply in the labour market and as a result workers have less bargaining power when it comes to wages and therefore have to accept lower wages.

A fall in output from Y1 - Y2 also means that other factors of production are being under utilised; capital goods are not being productive and this can have an impact of productivity...

What is happening with the UK's output gap?

According to the above graph the output gap is actually improving. 2010 saw the output gap reaching 4% but from 2010 onwards we have seen the output gap fall to around 2.5%. Be careful when interpreting diagrams in the exam. Read the axis carefully.

Unit 4: Scotland and the Euro - Should they abandon sterling?

Click here to access an intyeresting article on Scotland's independence. The growing dissent over Alex Salmond's desire for a sterling zone with the UK after independence has divided the 'yes' movement. Dennis

Canavan, a veteran Labour and then independent politician who now chairs 'Yes Scotland', told the BBC his preference was for a post-independence Scotland to have its own currency and even opt for the euro in future.

An interesting read and has some advantages of staying with sterling.

Canavan, a veteran Labour and then independent politician who now chairs 'Yes Scotland', told the BBC his preference was for a post-independence Scotland to have its own currency and even opt for the euro in future.

An interesting read and has some advantages of staying with sterling.

Saturday, 4 May 2013

Unit 4: Paragraph structure for strong evaluation and 10 thought on exam technique!

This presentation looks at three evaluation questions in A2 macro and suggests an approach to scoring high marks for evaluation. (thank you to Geoff for this)

Thursday, 2 May 2013

Unit 4: Globalisation at its finest!

Is this as crazy as it sounds?

Click here for amazing piece on moving workers around the world to cover night shifts in UK!!!!

Click here for amazing piece on moving workers around the world to cover night shifts in UK!!!!

Unit 2 and 4: ECB Cut interest rates to new low

See below an article from the BBC....questions to discuss include:

1. Will the rate cut actually work?

2. Does any 'One size fits all' policy work in a 17 nation monetary union??

The European Central Bank (ECB) is widely expected to cut interest rates later, as it seeks to boost growth amid ongoing fears for the eurozone economy.

A cut would be the first in 10 months, and reduce its key interest rate to a new record low.

Currently rates are at 0.75%, but there have been calls for a further cut amid continuing concerns over the economy, and receding inflationary fears.

The ECB is due to announce its decision at 13:45 local time (12:45 BST).

Official data released on Tuesday showed record high unemployment in the eurozone, and inflation at a three-year low.

That has increased the gloom over the eurozone economy, in which many members remain either in recession or suffering from low growth.

Austerity fears

Many economists had already speculated that lower interest rates from the ECB were likely, but said the fresh data released this week made the case for a cut even stronger.

The majority of economists polled by the Reuters news agency are forecasting that rates will be reduced to 0.5%.

Markets are likely to react positively to a cut, but it is not clear what impact, if any, the move will have on the real economy.

In recent months there have been growing calls for European countries to move away from austerity measures, which critics say are stifling growth.

Instead there are calls for a greater focus on stimulus measures.

Both French President Francois Hollande and newly-elected Italian Prime Minister Enrico Letta have urged a reconsideration of austerity policies.

But there are concerns that changes to the ECB's interest rates are not feeding through to those economies most in need of a boost, with potential lenders still worried about the economic health of countries such as Greece and Spain.

1. Will the rate cut actually work?

2. Does any 'One size fits all' policy work in a 17 nation monetary union??

The European Central Bank (ECB) is widely expected to cut interest rates later, as it seeks to boost growth amid ongoing fears for the eurozone economy.

A cut would be the first in 10 months, and reduce its key interest rate to a new record low.

Currently rates are at 0.75%, but there have been calls for a further cut amid continuing concerns over the economy, and receding inflationary fears.

The ECB is due to announce its decision at 13:45 local time (12:45 BST).

Official data released on Tuesday showed record high unemployment in the eurozone, and inflation at a three-year low.

That has increased the gloom over the eurozone economy, in which many members remain either in recession or suffering from low growth.

Austerity fears

Many economists had already speculated that lower interest rates from the ECB were likely, but said the fresh data released this week made the case for a cut even stronger.

The majority of economists polled by the Reuters news agency are forecasting that rates will be reduced to 0.5%.

Markets are likely to react positively to a cut, but it is not clear what impact, if any, the move will have on the real economy.

In recent months there have been growing calls for European countries to move away from austerity measures, which critics say are stifling growth.

Instead there are calls for a greater focus on stimulus measures.

Both French President Francois Hollande and newly-elected Italian Prime Minister Enrico Letta have urged a reconsideration of austerity policies.

But there are concerns that changes to the ECB's interest rates are not feeding through to those economies most in need of a boost, with potential lenders still worried about the economic health of countries such as Greece and Spain.

Unit 1: Supply and Demand - two different approaches

Thank you to Ben Cahill for this excellent article on Supply & Demand in action.....

As any good textbook (or website) will tell you, when producers seek to maximise profits, increased demand and the resulting higher prices are a signal to increase production. The first article is a classic example of this but the situation in the second is not quite the traditional textbook example!

The first article - "Hummus is conquering America" explains how increasing demand for hummus in the United States is leading tobacco farmers to change their crops in the new spring planting season. Hit by a long-term decline in tobacco sales, they are turning to the more lucrative (and much healthier) chick-pea that is the main ingredient in hummus. The article is full of great economics and is also useful for Business Studies teachers as well, with some insights on why the market for hummus is growing so fast in the USA.

The second article has the somewhat unusual headline of "Popular ice cream shop puts up prices to deter customers"! At first glance, it seems to support the traditional theory that a shortage will increase prices to a level of market equilibrium as the business realises it can maximise profits by charging higher prices. But the owner of the German ice-cream shop claims that this is not the case! His ice-cream is proving so popular (at the low price) that queues of people of up to 50 metres are waiting to buy it. This is drawing complaints from neighbouring businesses and the owner is worried that he might get shut down if the queues don't disappear. Hence the 35% increase in prices is to reduce "business to an acceptable level" and the most telling comment "The aim is not to make as much money as possible here." If true, then he obviously has goals other than profit maximization but the overall outcome is the same (if not the process) as predicted by the traditional theory!

As any good textbook (or website) will tell you, when producers seek to maximise profits, increased demand and the resulting higher prices are a signal to increase production. The first article is a classic example of this but the situation in the second is not quite the traditional textbook example!

The first article - "Hummus is conquering America" explains how increasing demand for hummus in the United States is leading tobacco farmers to change their crops in the new spring planting season. Hit by a long-term decline in tobacco sales, they are turning to the more lucrative (and much healthier) chick-pea that is the main ingredient in hummus. The article is full of great economics and is also useful for Business Studies teachers as well, with some insights on why the market for hummus is growing so fast in the USA.

The second article has the somewhat unusual headline of "Popular ice cream shop puts up prices to deter customers"! At first glance, it seems to support the traditional theory that a shortage will increase prices to a level of market equilibrium as the business realises it can maximise profits by charging higher prices. But the owner of the German ice-cream shop claims that this is not the case! His ice-cream is proving so popular (at the low price) that queues of people of up to 50 metres are waiting to buy it. This is drawing complaints from neighbouring businesses and the owner is worried that he might get shut down if the queues don't disappear. Hence the 35% increase in prices is to reduce "business to an acceptable level" and the most telling comment "The aim is not to make as much money as possible here." If true, then he obviously has goals other than profit maximization but the overall outcome is the same (if not the process) as predicted by the traditional theory!

Wednesday, 1 May 2013

Unit 2 and 4: Unemployment in the UK

Brief History of Unemployment in UK

Source: Dept for Work and Transport

After the ravages of the Great Depression era where unemployment was over 25%, unemployment in the UK remained relatively low from 1945 until the late 1970s. When Beveridge introduced the Welfare State in 1945, one thing he mentioned was the necessity of maintaining full employment. Using demand management policies and benefiting from a boom in global trade, the UK more or less achieved full employment, until the 1970s. In the 1970s, rising oil prices caused stagflation and unemployment began to rise but was still relatively low.

It was in the manufacturing recession of 1980-81 when unemployment rose to unprecedented levels. Not only did unemployment reach 3 million, but, it remained stubbornly high until 1986 well into the economic recovery. The huge rise in unemployment was due to the strong value of the Pound, high interest rates and the deflationary impact of strict monetarist policies. In particular, it was the manufacturing sector that suffered. Male full time, unskilled labour was particularly affected.

Unemployment remained high throughout the 1980s. Even at the peak of the boom in 1989, 1.6 million people were unemployed. This figure involved high rates of structural unemployment (also known as the natural rate of unemployment). This structural unemployment was because the recession of 1981 had made many unskilled workers unemployed. In the fast changing workplace, these former coal miners and ship builders struggled to get work in the new economy. Geographical unemployment was also a strong feature of the 1980s. Former areas of manufacturing and mining, struggled to cope with the large scale redundancies.

In 1991, unemployment rose again, as the economy slipped into another recession. Unemployment peaked in 1993 at just under 3 million. Unlike the 1980s, unemployment fell quicker. From the mid 1990s to 2008, UK unemployment was relatively low. Looking at official statistics, unemployment was fairly close to full employment at just over 3%.

Low unemployment was due to:

Long period of economic growth

Disguised unemployment, many unemployed were allowed to take sickness and disability benefits. Therefore, they are not counted as unemployed. See also: What is True Level of Unemployment?

The Labour Force survey has consistently been higher than the government record of people on Job seekers allowance. This reflects the fact it is very difficult to get benefits these days. Some unemployed are not eligible for benefits for a variety of reasons.

Regional Recovery. Former depressed areas like South Wales and the North East have been relatively successful in finding new industries to replace the old heavy manufacturing.

New Deal. Better education and training for the unemployed to get back to work.

This shows that unemployment is highly cyclical. When the economy goes into recession, unemployment typically has increased to 3 million.

Q) How would you solve the current unemployment issue in the UK?

Source: Dept for Work and Transport

After the ravages of the Great Depression era where unemployment was over 25%, unemployment in the UK remained relatively low from 1945 until the late 1970s. When Beveridge introduced the Welfare State in 1945, one thing he mentioned was the necessity of maintaining full employment. Using demand management policies and benefiting from a boom in global trade, the UK more or less achieved full employment, until the 1970s. In the 1970s, rising oil prices caused stagflation and unemployment began to rise but was still relatively low.

It was in the manufacturing recession of 1980-81 when unemployment rose to unprecedented levels. Not only did unemployment reach 3 million, but, it remained stubbornly high until 1986 well into the economic recovery. The huge rise in unemployment was due to the strong value of the Pound, high interest rates and the deflationary impact of strict monetarist policies. In particular, it was the manufacturing sector that suffered. Male full time, unskilled labour was particularly affected.

Unemployment remained high throughout the 1980s. Even at the peak of the boom in 1989, 1.6 million people were unemployed. This figure involved high rates of structural unemployment (also known as the natural rate of unemployment). This structural unemployment was because the recession of 1981 had made many unskilled workers unemployed. In the fast changing workplace, these former coal miners and ship builders struggled to get work in the new economy. Geographical unemployment was also a strong feature of the 1980s. Former areas of manufacturing and mining, struggled to cope with the large scale redundancies.

In 1991, unemployment rose again, as the economy slipped into another recession. Unemployment peaked in 1993 at just under 3 million. Unlike the 1980s, unemployment fell quicker. From the mid 1990s to 2008, UK unemployment was relatively low. Looking at official statistics, unemployment was fairly close to full employment at just over 3%.

Low unemployment was due to:

Long period of economic growth

Disguised unemployment, many unemployed were allowed to take sickness and disability benefits. Therefore, they are not counted as unemployed. See also: What is True Level of Unemployment?

The Labour Force survey has consistently been higher than the government record of people on Job seekers allowance. This reflects the fact it is very difficult to get benefits these days. Some unemployed are not eligible for benefits for a variety of reasons.

Regional Recovery. Former depressed areas like South Wales and the North East have been relatively successful in finding new industries to replace the old heavy manufacturing.

New Deal. Better education and training for the unemployed to get back to work.

This shows that unemployment is highly cyclical. When the economy goes into recession, unemployment typically has increased to 3 million.

Q) How would you solve the current unemployment issue in the UK?

Subscribe to:

Comments (Atom)