I don't think anybody has any idea what the economic impact of Brexit will be. Steve Eisman

Total Pageviews

Thursday, 24 March 2016

Unit 3 & 4: Economics Revision Work Book - Please download and photocopy!

Excellent resource to help your revision over the holidays.

Wednesday, 23 March 2016

Monday, 21 March 2016

Sunday, 20 March 2016

Unit 2: Iain Duncan Smith quits - Prime Ministerial Power

Morning everyone. Big news last week re the Conservative Party. It seems that once again Europe is causing big splits in the party. Iain Duncan Smith resigning over cuts to disability benefits is, I think, a thinly veiled dig at Camerons support for EU membership.

Click here for the article. Really good for examples of how 'front benchers' and the executive still have some power and ultimately how the Prime Minister needs the support of his party.

Click here for the article. Really good for examples of how 'front benchers' and the executive still have some power and ultimately how the Prime Minister needs the support of his party.

Thursday, 17 March 2016

Unit 1: Inelastic supply - perfect example - Whisky

A must read for Y12 (and any Y13 retakers) - I will be discussing on Sunday/Monday

Bottoms up!

Whisky lovers are draining the world’s supply of old single malt Scotch.

Thirst for

the liquor is booming around the world — from the U.S. to developing countries

like China — pushing prices of older vintages through the roof, attracting

savvy investors hoping to cash in and forcing distilleries to scramble to meet

demand.

“The shortage

of old and rare single malt … has already started, and it’s going to get

worse,” said Rickesh Kishnani, who launched the world’s first whisky investment

fund.

The problem

is that age-labeled single malt Scotch has always been, by design, a limited

commodity. Distillers produce a set amount in a given year with pretty much

zero visibility about what demand will be like when the bottles start hitting

venerable ages.

The industry

woke up to the current boom too late. In the late 1980s, many distilleries were

going out of business, and just a decade ago, Scotch exports were stagnating.

More capacity

is being added now, but the bad news for whisky drinkers is the shortage could

last another 10 to 15 years, experts say.

Asia finds

its love for Scotch

Enthusiasm

for single malt Scotch — whisky made from the product of a single distillery

rather than a blend — continues to surge. In the U.S., annual sales nearly

tripled between 2002 and 2015, according to the Distilled Spirits Council of

the United States.

Global single

malt exports jumped 159% between 2004 and 2014, according to the Scotch Whisky

Association. Asia now accounts for one-fifth of all Scotch exports, buying up a

quarter of a billion bottles a year.

“In China,

everybody is talking about it,” said Stephen Notman of the Whisky Corporation,

a whisky investment firm. “Nobody thought in a million years that there would

be a market there for 30-, 40-year-old whisky.”

The world’s

most expensive Scotch was sold in Hong Kong: a large crystal decanter holding

Macallan “M” whisky went for a whopping $628,205 at a Sotheby’s auction in

2014.

Pumping out more whisky

To combat the

single malt drought, some distillers are ramping up production.

“We are

currently working at full capacity — seven days a week, 24 hours a day,” said

Charlie Whitfield, a brand manager for Macallan. “We just need to be patient

and allow those casks to work their magic.”

By early

2018, Macallan, one of the world’s most popular Scotch brands, will have a

second distillery online. But it won’t be releasing bottles immediately — by

law, all Scotch whisky must be aged for a minimum of three years.

In recent years, brands including Macallan, Highland Park and Oban have also started rushing out bottles whose labels don’t mention the whisky’s age.

It’s yet

another way to help offset the strain on supply, as it gives Macallan the

ability to release the best whiskies at its disposal rather than waiting years

to put out more, Whitfield said.

Getting rich off the single malt drought

Meanwhile,

prices are skyrocketing for older whiskies. For example,

a Black Bowmore whisky aged for 30 years before its 1994 release initially went

on sale for $110 a bottle. But it now easily goes at auction for $7,000, said

Notman.

The

Investment Grade Scotch Whisky Index, which tracks auction prices, climbed 14%

last year, beating other traditional assets. Gold tumbled more than 10% over

the same period, while the S&P 500 was little changed.

Kishnani’s

whisky fund in Hong Kong, an ever-growing collection of 7,500 bottles, has

increased 26% in value since it started in 2014. The fund also includes older

Japanese whiskies, which are similarly spiking in value. “Silent stills,”

whiskies from closed-down distilleries, like Karuizawa, are doing exceptionally

well, as stocks are even more limited.

With more

supply on the way, prices will eventually peak in the years to come, said David

Wainwright, who owns a wine and spirits advisory firm.

But for now,

“there’s still plenty of mileage left out there,” he said. “Single malt Scotch

prices definitely still have further to go.”

All Economics Students

Thank you very much to Adrian Spottiswoode, an Economics teacher from the UK for the following article and link to a podcast....

For the last 5 years I’ve listened to every weekly episode of the “Econtalk” podcast. In my opinion, it is by far the best Economics podcast there is, and I strongly urge all with an interest in Economics to give it a try.

It’s hosted by Russ Roberts, an American academic who is extremely skilled at communicating complex ideas in a way we can all understand. He’s also a great example of someone who has a certain set of ideological beliefs – he is an avowed economic liberal – but who attempts to transcend partisanship through judicious application of the economic way of thinking.

Some of the most famous economists past and present have been on his show - Gary Becker, Thomas Piketty, Ronald Coase, Nassim Taleb, Robert Solow, Yanis Varoufakis, Joseph Stiglitz, Milton Friedman….

The range of subjects covered is extraordinary. So far in 2016, it's discussed why promising medical treatments often go wrong, whether econometrics really leads to improved understanding and policy, the lucrative second-hand market in Air Jordans, the economics of risk taking and whether government or businesses are best placed to take care of workers and induce growth.

It’s must-listen for all Economics students!

And to give you a better idea of the kind of discussion featured in the podcast, here’s a summary of one of my favourite recent episodes.

Unit 2 & 4: Budget 2016 - Fiscal Policy

George Osborne has delivered his eighth Budget as chancellor. Click here to access the main points of what he said.

Points for discussion:

Is this an expansionary budget or a contractionary one?

Will this improve market failure?

How will it effect Aggregate Demand?

How could it effect Aggregate Supply?

What could the economic effects of this budget be for the UK economy?

Points for discussion:

Is this an expansionary budget or a contractionary one?

Will this improve market failure?

How will it effect Aggregate Demand?

How could it effect Aggregate Supply?

What could the economic effects of this budget be for the UK economy?

Monday, 14 March 2016

Unit 2 & 4: The ECB and monetary policy

There was a surprise monetary policy move by the European Central Bank (ECB) today with the announcement of extra quantitative easing, a move to buying corporate as well as government debt, together with a looser (more expansionary) interest rate policy with cuts to both the main policy rate and also the bank deposit rate.

Click here for an article explaining the reasons behind the move.

Will it work? (in an exam, you would argue both the case for and against)

Click here for an article explaining the reasons behind the move.

The ECB has also introduced some conditional funding - there is more generous funding for commercial banks providing that they are lending to businesses and consumers.

Designed primarily to send a message to the markets that the ECB means business in trying to stimulate the moribund Euro Zone economy and also to bring about a depreciation of the Euro, after a few hours it seemed that the markets were calling the ECB's bluff - the Euro was appreciating in the markets although stock markets were higher.

Is this the last chance saloon for the ECB? Where next for monetary policy inside the Euro Zone?

Questions for discussion:Will it work? (in an exam, you would argue both the case for and against)

Unit 2 & 4: Policies for women

This great 1 minute infographic-style clip from the IMF outlines the possible economic impact of replacing men with women in senior positions in business across Europe.

Sunday, 13 March 2016

Unit 2 & 4: Inflation In China

Chinese inflationary pressures accelerated sharply in February on the back of huge spike in food prices. According to the National Bureau of Statistics, consumer prices rose by 2.3% from 12 months earlier, easily beating expectations for an increase of 1.9%...Click here for the article.

Some questions for discussion: (these are types of question you would get in an exam)

What is the driver of inflation?

What kind of inflation is it?

How would you solve the issue?

Is it actually a big issue for China?

Some questions for discussion: (these are types of question you would get in an exam)

What is the driver of inflation?

What kind of inflation is it?

How would you solve the issue?

Is it actually a big issue for China?

Wednesday, 9 March 2016

Monday, 7 March 2016

Sunday, 6 March 2016

Unit 4: Nigeria & Zimbabwe - Oil & Diamonds

On the way to work this morning I heard two contrasting policies on primary products in Africa.

Firstly in Zimbabwe, Mugabe has just announced that the government will take over production of diamond mining. He accuses the foreign investotrs (mainly China) of 'Stealing their property'. Click here for the article.

In Nigeria however, the government are doing the complete opposite to their state run oil industry. They are turning the state run monopoly into 30 'profit making' private companies. Click here for the article.

Question for discussion: Assess the benefits to both countries of these two, very different, policies.

Firstly in Zimbabwe, Mugabe has just announced that the government will take over production of diamond mining. He accuses the foreign investotrs (mainly China) of 'Stealing their property'. Click here for the article.

In Nigeria however, the government are doing the complete opposite to their state run oil industry. They are turning the state run monopoly into 30 'profit making' private companies. Click here for the article.

Question for discussion: Assess the benefits to both countries of these two, very different, policies.

Wednesday, 2 March 2016

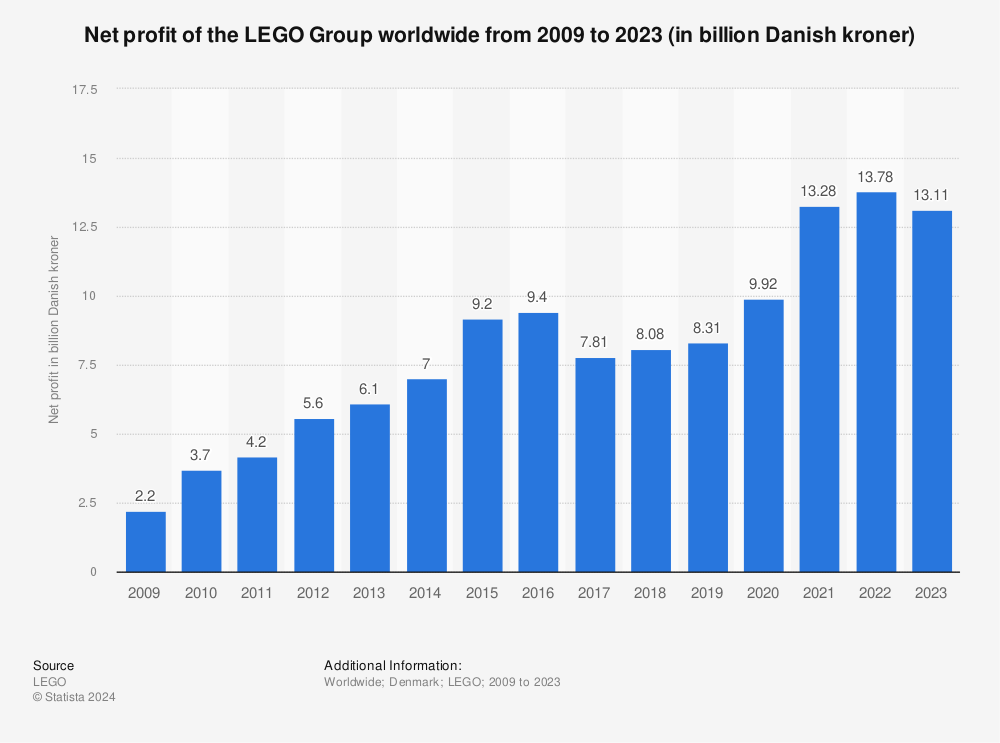

Unit 3 & 4: Lego expanding to emerging markets

The family-owned toy maker Lego has reinforced their position as the world's biggest toy maker and now they are focused on expanding in Asia and also (eventually) in Africa. At present, 80% of Lego's sales are to countries that only contain 20% of the world's children. There is clearly huge opportunity for rapid sales growth in emerging markets - a case perhaps of selling more bricks to the BRICS and beyond?

Unit 1 & 4: Copper Prices, primary product dependency, globalisation, economic development

An excellent article that is useful for both AS and A2 students!

An excellent article that is useful for both AS and A2 students!Click here for the video clip showing impact on falling copper prices.

Click here for another article and video clip.

Questions for discussion:

AS - Why has the price of copper fallen? (use a supply & demand diagram)

AS - Is demand for copper likely to be inelastic or elastic?

A2 - Would this happen if company was owned by Zambian govt rather than a multi national?

A2 - What is the impact on the Zambian economy of being primary product dependent

A2 - How are the government and the people trying to adapt from this crisis?

Labels:

copper,

development,

globalisation,

primary product dependency,

zambia

Unit 1: Government Failure - The War on Drugs

A controversial, but relevant example of government failure. A concept that comes up every year in Unit 1 questions. Obviously it is very unlikely you will get a question on drugs, but the concepts are the same. Government intervening in a market to reduce market failure, but actually making things much worse!

Tuesday, 1 March 2016

Unit 2: Balance of trade presentation & Past Paper Practise

This paper focus' on many macro concepts. The area I want you to look at today is the current account balance of payments questions from Q1.

Subscribe to:

Comments (Atom)