A short revision video covering consumer surplus and the effects of shifts in supply and demand and also maximum prices on the level of consumer surplus. Consumer surplus is one measure of economic welfare.

I don't think anybody has any idea what the economic impact of Brexit will be. Steve Eisman

Total Pageviews

Wednesday, 13 December 2017

Monday, 11 December 2017

Sunday, 10 December 2017

Suppy & Demand - The price of wool collapses in the UK

Click here to access an article on wool prices in the UK. Useful in determining factors affecting supply and demand. How could sheep farmers react to this?

Thursday, 7 December 2017

A2 Microeconomics - Course Companion

Thank you to Geoff and the team for this course companion. Everything you need to know about micro economics for the A level examination.

Monday, 27 November 2017

All year groups: Post Brexit Britain - Macro economic ideas

Click here for a really interesting article on how the government is trying to ensure the UK economy grows post BREXIT.

Lots of macro economics here, with evaluation points and links to other useful pages discussing the UK economy. What are your thoughts?

Lots of macro economics here, with evaluation points and links to other useful pages discussing the UK economy. What are your thoughts?

Thursday, 23 November 2017

Tuesday, 21 November 2017

Price Discrimination - Railcard in the UK

Railcards offering discounted train travel are to be extended to people up to 30 years old. Click here to access the article. Links to price discrimination, consumer surplus, short run shut down point.

Fiscal Policy - UK Govt Spending in 2017

The north of England has seen the biggest cuts in government spending over the past five years, official figures show. Click here to read the article. Year 11 - What impact could this have on the main economic objectives?

Sunday, 19 November 2017

Oligopoly - Prisoners Dilemma (more game theory)

I doubt we will get to this tomorrow, but for some extra reading, try this.

Labels:

game theory,

golden balls,

oligopoly,

prisoners dilemma

Oligopoly - Game theory

If you get chance before tomorrows lesson, check out the presentation below. It will help explain why oligopolistic markets tend to have stable (or rigid) prices and why they tend to collude.

Labels:

game theory,

kinked demand curve,

oligopoly,

prisoners dilemma

Crowding out - issues with fiscal policy

Useful piece on 'Crowding Out'. A concept used when discussing fiscal policy and some of the disadvantages of governments borrowing to spend.

Saturday, 18 November 2017

Degrees that make you rich...bet you love these stats Danny boy!

Click her to access...btw, I bring the average down!

Thursday, 16 November 2017

Contestable Markets: Indie coffee shops on the rise!

Click here to access an article discussing the rise of small independent coffee shops. This begs the question, how contestable is the coffee market. There are clearly a few large firms that dominate the market (Starbucks, Costa etc), but do they behave like oligopolies or are they competing as if there is a threat of competition?

Click here to access an article discussing the rise of small independent coffee shops. This begs the question, how contestable is the coffee market. There are clearly a few large firms that dominate the market (Starbucks, Costa etc), but do they behave like oligopolies or are they competing as if there is a threat of competition?This is a typical question on the topic of contestability!

Labels:

coffee shops,

contestable markets,

costa,

starbucks

Tuesday, 14 November 2017

Worried Cornwall (BREXIT county) asks for Government help!

Is this a sign of things to come? Cornwall has called for help from the Government amid fears it will be left without enough people to work its farms post-Brexit. Click here to access link.

Is this a sign of things to come? Cornwall has called for help from the Government amid fears it will be left without enough people to work its farms post-Brexit. Click here to access link.This could be a real issue for certain industries. Agriculture and the hotel industry are already feeling the effects of BREXIT, with immigrants coming to the UK to pick cabbages etc at an all time low. The fear is that many sectors in Cornwall rely on European workers and as a consequence will struggle to fill many vital positions. “Broccoli is already lying unpicked in the fields.”

Sunday, 12 November 2017

Here it is - the latest in the iconic series of heart-tugging Christmas adverts from John Lewis. A rumoured £7m investment for something they hope will have a very short payback period - and perhaps longer-term returns in terms of brand value. An example of game theory in action...check out Marks and Spencer ad as well. It is estimated around 6 billion pounds will be spent on advertising this christmas!!!

Here are the previous ads for you to compare!

Oligopoly: Concentration ratios - Activity

Click here to access an activity. In the activity there are 6 pairs of firms belonging to markets which are oligopolistic in the UK. Your task is to match the pairs in the smallest number of incorrect moves as possible.

Fun times!

Fun times!

Monday, 6 November 2017

Underemployment - A real issue for economists

If you are overqualified for your role, are you causing more trouble for your firm than you are worth? 'Underemployment' is a relatively new concept in A Level syllabus, but it is just as important as unemployment. Click here to access BBC article on the subject.

Sunday, 5 November 2017

Saturday, 4 November 2017

Diminishing returns

Diminishing returns (short run):-

As more of a variable factor (e.g. labour) is added to a fixed factor (e.g. capital), a firm will reach a point where the marginal product of labour will fall, thus raising marginal cost and average variable cost.

Thursday, 2 November 2017

MCQ Practice Questions - Government Intervention in the Market

Some more questions for you to practice on.....

Monetary Policy: UK &Interest Rates - Most anticipated decision in a decade

The Bank of England will deliver one of the most closely watched interest rate decisions since the financial crisis later on Thursday. Click here to access the article.

The Bank of England will deliver one of the most closely watched interest rate decisions since the financial crisis later on Thursday. Click here to access the article.Hopefully you will come to class to discuss next week.

Wednesday, 1 November 2017

MCQ Practice questions - Suuply & Demand

Have a go at these 3 questions - Useful for everyone, including Y10 & Y11.

Tuesday, 24 October 2017

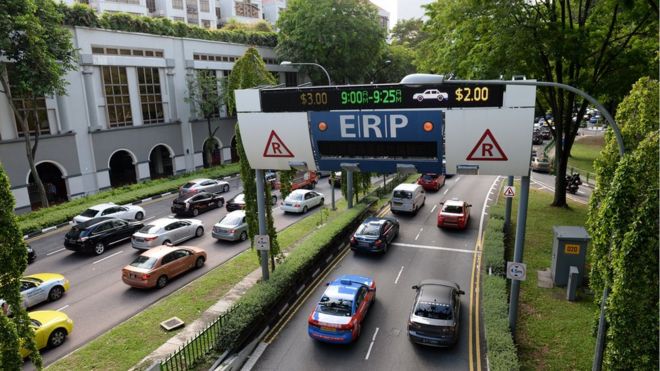

Market Failure: More on how to reduce congestion - Singapore Style

Click here to access article on Singapore's answer to reducing traffic congestion.

Click here to access article on Singapore's answer to reducing traffic congestion.How effective will it be?

What are the economic consequences of the policy?

Monday, 23 October 2017

Minimum Pricing Scheme: Alcohol in the UK

Click here to access an interesting piece on new legislation on the pricing of alcohol in Wales. Lots of economics here, including:

Click here to access an interesting piece on new legislation on the pricing of alcohol in Wales. Lots of economics here, including:Market Failure

Externalities

Government intervention

Government failure

Impact on different demographics

Is this the way forward? How would you tackle the issue?

Labels:

alcohol,

externalities,

Government Failure,

minimum pricing

Saturday, 21 October 2017

Traffic jams and market failure

Click here to access a recent piece in the Guardian about congestion in the UK. It is a real problem with estimates of cost to the economy in the billions!

Click here to access a recent piece in the Guardian about congestion in the UK. It is a real problem with estimates of cost to the economy in the billions!Classic example of market failure, government failure, opportunity cost, scarce resources, you name it....

Wednesday, 18 October 2017

Three, must watch movies for economists!

There are hundreds of movies about macro economics and its impact on society and people lives, here are three (academy award nominated) recent ones!

Also, check out this latest post from the Key.

Also, check out this latest post from the Key.

All Year Groups: Inflation in UK hits a 5 year high

Click here to access an article from the BBC on the latest rate of inflation data! What does this mean for interest rates? What does this mean for pay and living standards in the UK? Why has this happened?

Click here to access an article from the BBC on the latest rate of inflation data! What does this mean for interest rates? What does this mean for pay and living standards in the UK? Why has this happened?Saturday, 14 October 2017

Bernie Saunders on Trade Unions

Short interview with Bernie Saunders explaining the benefits to society of having strong trade unions.

Labour Markets - Wage determination

The labour market wage determination from mattbentley34

Essay Question:

Although there has been laws against wage discrimination for many years in the UK, women's average wages are still around 20% less than men.

Explain the factors that might account for the continuing difference between male and female earnings. (15 Marks)

Assess the view that increased trade union membership is the best way to raise women's earnings. (25 Marks)

Essay Question:

Although there has been laws against wage discrimination for many years in the UK, women's average wages are still around 20% less than men.

Explain the factors that might account for the continuing difference between male and female earnings. (15 Marks)

Assess the view that increased trade union membership is the best way to raise women's earnings. (25 Marks)

Tuesday, 10 October 2017

How does this guy compete?

A possible business opportunity for BSAK students?!

The clip shows how a budding entrepreneur made some big money by selling sweets in the school playground.

The machines are taking over!

Click here to access an interesting piece from the World Bank! It seems we are all doomed. So lets just not bother with school for today!

Click here to access an interesting piece from the World Bank! It seems we are all doomed. So lets just not bother with school for today!Again, I don't just post this for fun. It has a real point behind it. To ensure jobs and living standards improve for all, we need to educate, educate, educate..but where does the money come from?

Saturday, 7 October 2017

Labour Market failure, minimum wage and trade unions

This first presentation is a general comment on all aspect of market failure in the labour market. The second two look specifically at theory behind Minimum Wage and Trade Unions, how they affect the labour market and the potential advantages of them to society.

UK competitiveness - More depressing reading

Click here to access yet another article on UK competitiveness. This is now becoming a hot topic in the UK and besides making very interesting reading, it is highly likely to turn up on next summers exam paper.

Click here to access yet another article on UK competitiveness. This is now becoming a hot topic in the UK and besides making very interesting reading, it is highly likely to turn up on next summers exam paper.What does the article suggest the reasons are for the fall in productivity?

What can we do about this?

Monday, 2 October 2017

International Competitiveness - 2017 data is out

This clip highlights how countries become more or less competitive, excellent when looking at supply side economics. The increase in competitiveness does always benefit all. You would need to look beyond the data and evaluate the potential issues of just how a country has achieved its success!

Click on this link to explore the data further. Where is the UAE for example and why might this be the case?

Click on this link to explore the data further. Where is the UAE for example and why might this be the case?

Saturday, 30 September 2017

Monetary Policy - The difficulties facing the MPC

The two articles below from the BBC business section came out on the same day. This highlights the issue of monetary policy, inflation, BREXIT, employment, growth...the lot!

The two articles below from the BBC business section came out on the same day. This highlights the issue of monetary policy, inflation, BREXIT, employment, growth...the lot!Article one

Article two

Questions for discussion:

What are the short term implications of a rise in interest rates?

What might the long term issues be?

Do you think Mark Carney is right to suggest rates will rise?

Tuesday, 26 September 2017

Monday, 25 September 2017

Competition, oligopoly, kinked demand curve and supermarkets

Click here to access an article which looks at how Aldi reporting record sales but recording lower profits. A classic example of the kinked demand curve in action!

Click here to access an article which looks at how Aldi reporting record sales but recording lower profits. A classic example of the kinked demand curve in action!Questions for discussion:

Why are Aldi sacrificing profits for more sales?

What does this suggest about the elasticity of demand for supermarket shopping?

Labels:

Aldi,

kinked demand curve,

oligopoly,

supermarkets

Saturday, 23 September 2017

Market Failure - Junk Food and Obesity

A classic case study of the issues of increasing consumption of junk food. Not only is this a health issue, but also an economic one as well. How would you solve the problem?

Labour Markets - Do some of the newly employed have zero productivity?

Whether due to limited ability or a lack of incentive, the output of some workers taken on in the jobs boom is close to zero. And this drags the average down.

The UK jobs market is booming, as the latest ONS figures show. Unemployment is at its lowest for over 40 years. A record 32.1 million people are in employment, a rise of over 3 million since the financial crisis. Apart from in a few scattered pockets, Britain is at full employment.

Usually in such circumstances, wages would start to outpace inflation. Labour shortages would lead employers to start bidding for workers, who would themselves feel more confident about demanding pay increases.

Perhaps this is starting to happen, with the TUC voting for a campaign to raise public sector wages by 5 per cent. But a combination of immigration and a concerted government campaign to get people off benefits means that the supply of labour has risen sharply. This holds down the price of labour, the wage, in the bottom half of the labour market. Instead, full employment manifests itself in different ways.

A few anecdotes might illustrate the key points:

I recently bought a new phone, which has proved to have an intermittent fault. The Richmond branch of EE advertises both on the internet and on its doors that it opens at 9.30am. I turned up at 9.40 to find the place in darkness. I went to another EE branch, where a listless young woman informed me that she could not replace it. I asked what she could do. She replied that she could take it in for repair, but that this “would take three weeks”. I left, and she slumped back to her stupor.

Later that day, I went to see someone at a leading London university. The department receptionist asked if I had the extension number. When I said I was rather hoping he might have it, he responded that he probably did, but that it would be “hard to find”. We looked at each other in silence. Then a light bulb came on in his mind. He winked at me, and pronounced “I’ll take you up there”.

These experiences are not confined to the dynamic capital city. A few weeks ago, I visited the maths department at Durham and left my glasses behind. They offered to post them guaranteed next day delivery. I tracked the parcel on the Royal Mail website. 39 hours later, it had arrived at the Newcastle sorting centre, all of 15 miles away.

These examples of appalling service arise for two reasons. First, the very high demand for labour means that some people now in jobs are scarcely able to perform work at all. Second, many low paid workers realise they can easily get another job, so why bother making an effort in your current one?

Here is part of the answer to the so-called productivity puzzle. During the recovery from a recession, productivity, output per worker, usually rises quickly. But it has been flat.

Perhaps we need to find some of these guys to help with productivity? Click here for video

The UK jobs market is booming, as the latest ONS figures show. Unemployment is at its lowest for over 40 years. A record 32.1 million people are in employment, a rise of over 3 million since the financial crisis. Apart from in a few scattered pockets, Britain is at full employment.

Usually in such circumstances, wages would start to outpace inflation. Labour shortages would lead employers to start bidding for workers, who would themselves feel more confident about demanding pay increases.

Perhaps this is starting to happen, with the TUC voting for a campaign to raise public sector wages by 5 per cent. But a combination of immigration and a concerted government campaign to get people off benefits means that the supply of labour has risen sharply. This holds down the price of labour, the wage, in the bottom half of the labour market. Instead, full employment manifests itself in different ways.

A few anecdotes might illustrate the key points:

I recently bought a new phone, which has proved to have an intermittent fault. The Richmond branch of EE advertises both on the internet and on its doors that it opens at 9.30am. I turned up at 9.40 to find the place in darkness. I went to another EE branch, where a listless young woman informed me that she could not replace it. I asked what she could do. She replied that she could take it in for repair, but that this “would take three weeks”. I left, and she slumped back to her stupor.

Later that day, I went to see someone at a leading London university. The department receptionist asked if I had the extension number. When I said I was rather hoping he might have it, he responded that he probably did, but that it would be “hard to find”. We looked at each other in silence. Then a light bulb came on in his mind. He winked at me, and pronounced “I’ll take you up there”.

These experiences are not confined to the dynamic capital city. A few weeks ago, I visited the maths department at Durham and left my glasses behind. They offered to post them guaranteed next day delivery. I tracked the parcel on the Royal Mail website. 39 hours later, it had arrived at the Newcastle sorting centre, all of 15 miles away.

These examples of appalling service arise for two reasons. First, the very high demand for labour means that some people now in jobs are scarcely able to perform work at all. Second, many low paid workers realise they can easily get another job, so why bother making an effort in your current one?

Here is part of the answer to the so-called productivity puzzle. During the recovery from a recession, productivity, output per worker, usually rises quickly. But it has been flat.

Perhaps we need to find some of these guys to help with productivity? Click here for video

Monday, 18 September 2017

Labour Markets - An introduction

Labour Markets are a big part of A2 Economics. The following presentation covers all aspects of the syllabus.

Monday, 19 June 2017

Theme 1: Innovative transport policy in Oslo, Norway

Thank you to Abigail for finding this article on Norway's solution to traffic issues in Oslo. Excellent application for any question on transport policy.

Click here for a short video on the policy.

Click here for a short video on the policy.

Labels:

negative externalities,

Norway,

Oslo,

transport

Sunday, 18 June 2017

Paper 3 - MCQ's on all topics

Click here to access the link to several multi choice questions on all topics. Useful for revision

Sunday, 11 June 2017

Theme 4 / Paper 2: Revision Videos for this weeks exam

Click here to access a long list of revision videos for the upcoming Paper 2.

All themes: Excellent you tube page

Click here to access an excellent you tube site dedicated to all things economics. I will also put it on the revision websites section of my blog (right hand side), so it will always be there for you.

Saturday, 10 June 2017

Thursday, 8 June 2017

Theme 2 & 4: Keynesian Economics

The new spec is keen to develop students knowledge of economic thinkers such as Keynes, Smith, Hayek etc. I suggest you spend some time this week looking at what their key ideas are (basically free market Vs intervention approach.

Here is a summary of Keynesian economics....please watch and come to school to discuss (I'm not in on Monday!)

Really useful when looking at questions such as: An understanding of Keynesian ideas can be helpful in evaluating macroeconomic stability in terms of prices, jobs and incomes. Keynesians believe that free markets are volatile and not always self-correcting in the event of an external shock The free-market system is prone to lengthy periods of recession & depression Economies can remain stuck in an “underemployment” equilibrium In a world of stagnation or depression, direct state intervention may be essential to restore confidence and lift demand. Keynes was one of the first economists to criticise the profession for adhering to unrealistic assumptions “In terms of economic policy Keynesian economics has only one proposition: that governments should make sure that aggregate demand is sufficient to maintain a full-employment level of activity.”

Here is a summary of Keynesian economics....please watch and come to school to discuss (I'm not in on Monday!)

Really useful when looking at questions such as: An understanding of Keynesian ideas can be helpful in evaluating macroeconomic stability in terms of prices, jobs and incomes. Keynesians believe that free markets are volatile and not always self-correcting in the event of an external shock The free-market system is prone to lengthy periods of recession & depression Economies can remain stuck in an “underemployment” equilibrium In a world of stagnation or depression, direct state intervention may be essential to restore confidence and lift demand. Keynes was one of the first economists to criticise the profession for adhering to unrealistic assumptions “In terms of economic policy Keynesian economics has only one proposition: that governments should make sure that aggregate demand is sufficient to maintain a full-employment level of activity.”

Monday, 5 June 2017

Saturday, 3 June 2017

Paper 1: Tariffs & quotas - a contextual example

A good contextual example here of import quotas and import tariffs in tandem! Think carefully about the impact of the tariffs not just on the consumer, but also the companies that use sugar as a raw material.

According to reports, China, the world’s biggest sugar importer, will levy an extra 45% import duty in addition to its current 50% tax on out-of-quota sugar imports, from May 22 to May 21 next year.

The country allows just under 2 million metric tons of sugar imports at a duty of 15% every year, as part of its commitments to the World Trade Organization. But for out-of-quota sugar imports, China imposes a 50% duty currently. The tax rate will be reduced to 40% for the following year, and then 35% in the year after that, according to the Commerce Ministry statement.

The aim of the quotas and the import tariff is designed to provide protection for domestic sugar producers - but keen economists will be able to both analyse and evaluate the extent to which trade barriers do protect producers in the long run and the spillover effects for Chinese consumers and other industries that use sugar as a raw material.

Paper 2: Infrastructure spending in the UK.

Students always talk about infrastrucure spending, without really knowing why it is so important. Here is a short revision video on the importance of infrastructure spending for both aggregate demand and long run aggregate supply. Economic growth places rising demand on a country's infrastructure assets and the UK is ranked only 28th out of 138 countries globally for the perceived quality of our transport, telecoms, power and other critical infrastructure.

Paper 3: Another possible 25 marker: Net migration into UK

This could also be a good question which looks at micro and macro effects of the fall in net migration into the UK post BREXIT.

Thursday, 1 June 2017

Paper 2: 25 mark essay on monetary & supply side policies

Useful to help you answer an essay on economic policy - paper 2

Wednesday, 31 May 2017

MUST WATCH - FOR PAPER 1 NEXT WEEK

Thank you to Geoff and the team for producing these excellent revision videos on theory of the firm.

Click here to access. I would like to go through them next week.

Click here to access. I would like to go through them next week.

Labels:

25 markers,

essay question,

model answer,

revision material

Monday, 29 May 2017

Theme 3: Labour Markets

See below for a series of webinars discussing all issues related to labour markets.

Here is a link to all resources on labour markets.

Here is a link to all resources on labour markets.

Saturday, 27 May 2017

Assessment Week Paper 2 - Macroeconomics

Can I suggest you look at the following when revising for paper 2:

Index numbers (again)

Deflation

Under-employment

Negative output gap - remember diagrams

Taxes and tax allowances (easy to get second one wrong)

Net trade

Causes of trade deficit

GDP/capita - causes of change

policies to improve productivity (NOT production)

Essay questions

benefits of econ growth

is recession inevitable

The essays will need you to look at the data as well as you own knowledge.

Index numbers (again)

Deflation

Under-employment

Negative output gap - remember diagrams

Taxes and tax allowances (easy to get second one wrong)

Net trade

Causes of trade deficit

GDP/capita - causes of change

policies to improve productivity (NOT production)

Essay questions

benefits of econ growth

is recession inevitable

The essays will need you to look at the data as well as you own knowledge.

Thursday, 25 May 2017

Theme 4: Micro and macro impact of a trade bloc - The EU

Here is a video recording of an A-level economics revision webinar on aspects of European Monetary Union.

- Monetary union is a deeper form of integration

- The single European currency, the euro, was introduced in 1999 and came into common circulation in January 2002

- No country has yet left the Euro Area

- As of May 2017, there are nineteen member nations

- Of the 28 EU countries (the UK leaves in 2019), 9 are not part of the single currency including Denmark, Hungary, the Czech Republic and Poland

Key problems facing the Euro Area economy

- High structural unemployment + hysteresis effects

- High levels of government debt + high bond yields for some

- Risks from price deflation

- Persistently low aggregate demand / spare capacity

- Fragile banking sector (non-performing loans)

- Weak capital investment – some diverting to emerging Asia

- Big trade / current account imbalances

- Political tensions and ongoing refugee crisis

- Declines in subjective wellbeing + rise in poverty

Where next for the Euro Area?

- Politics takes centre stage in 2017 (Austria, Holland, France and Germany all have key elections)

- Euro Area is showing stronger (cyclical) growth and falling unemployment with a reduced risk of deflation

- Is this enough for countries to climb out of the debt crisis?

- Banking systems remain fragile (especially in Italy)

- Eurozone’s periphery is still in deep crisis

- Need for structural economic reforms remains

- Changing centre of global economic gravity is accelerating

- Big risk is that hysteresis effects of collapse in investment, structural unemployment and impact of rising inequalities and socio-economic insecurity will damage Europe’s trend growth and the potential to raise living standards.

Monday, 22 May 2017

Economic Growth Vs Economic Development

Click here tom access an interesting article on growth Vs development. A question that is being asked more and more in recent years. (also, interestingly, look where the UAE features)

Thursday, 18 May 2017

Monday, 15 May 2017

All Themes: Paper 3 essay question on BREXIT

Click here to access the data for your 25 mark essay question on BREXIT.

Click here to access the data for your 25 mark essay question on BREXIT.

With

reference to the information provided and your own knowledge, evaluate

the

likely microeconomic and macroeconomic effects of the UK leaving the European

Union. (25 Marks)

Theme 4: China's 'Belt and Road' project

Click here to access an excellent and very timely article on China, investment and economic development.

Click here to access an excellent and very timely article on China, investment and economic development.

Thursday, 11 May 2017

Monday, 8 May 2017

All themes: Multiple choice questions practice

Click here to access lots of multiple choice questions. Excellent for practice.

Theme 1: Revision videos from tutor2u

Click here to access 10 videos on all aspects of micro economics for AS. An excellent revision tool.

Wednesday, 3 May 2017

All themes: Multiple choice questions explained

This is an interesting question about whether a business should be concerned given information about the coefficient of elasticity of supply.

Here is a question about the effects of changes in world prices on the domestic consumption and export of a commodity.

Tuesday, 2 May 2017

Monday, 1 May 2017

Theme 4: 2 Essay Plans - Living standards & economic growth in developing countries

Here is a video taking students through a suggested answer to this 25 mark essay question.

“For developing countries in particular, economic growth must always be the most important macro policy objective.” With reference to examples, to what extent do you agree with this statement?

In this revision video we look at a possible answer to this 25 mark essay question:

"To raise standards of living, countries should focus solely on increasing GDP per capita." To what extent do you agree?

“For developing countries in particular, economic growth must always be the most important macro policy objective.” With reference to examples, to what extent do you agree with this statement?

In this revision video we look at a possible answer to this 25 mark essay question:

"To raise standards of living, countries should focus solely on increasing GDP per capita." To what extent do you agree?

Sunday, 30 April 2017

Theme 2 & 4: Essay Plan - Monetary and supply side policies

Here is a video recording of a revision webinar looking at shaping an answer to this 25 mark question.

“Monetary policy is as important as supply-side policies in making a country more internationally competitive” With reference to examples, to what extent to you agree?

“Monetary policy is as important as supply-side policies in making a country more internationally competitive” With reference to examples, to what extent to you agree?

Thursday, 27 April 2017

Theme 4: 25 mark essay question on tariffs

Here is a timely and relevant revision video looking at how to build a 25 mark answer to this essay question:

"President Trump has proposed a 20% tariff on Mexican imports, blaming free trade for US woes. To what extent is this going to harm the US economy more than it helps?"

"President Trump has proposed a 20% tariff on Mexican imports, blaming free trade for US woes. To what extent is this going to harm the US economy more than it helps?"

Wednesday, 26 April 2017

Theme 3 & 4: Nestle leaving UK to move to Poland!

When it comes to the crunch, capital flows to where the risk-adjusted expected returns are highest.

Several hundred jobs are at risk in the UK as Nestle announces that production of the Blue Riband chocolate bar is moving from Britain to Poland. Lower unit labour costs, favourable corporate tax rates and a competitive zloty (a floating currency) are three factors behind the move.

Click here to read a Guardian article on this.

Several hundred jobs are at risk in the UK as Nestle announces that production of the Blue Riband chocolate bar is moving from Britain to Poland. Lower unit labour costs, favourable corporate tax rates and a competitive zloty (a floating currency) are three factors behind the move.

Click here to read a Guardian article on this.

Tuesday, 25 April 2017

Theme 3: Contestable Markets essay

Here is an essay plan using the PECAN PIE technique for developing an answer to this question: "Neo-classical theory of competition implies that more firms in a market is the only way to improve outcomes for consumers”. With reference to examples, to what extent do you agree? (25 marks)

Monday, 24 April 2017

Theme 1: Cross Price elasticity of demand - evaluation

In this short video we build 3 analysis and evaluation points for this question: "Evaluate the significance of the coefficient of cross price elasticity for a business"

Thursday, 20 April 2017

Wednesday, 19 April 2017

Theme 3: Natural Monopolies - evaluation

Here is a short video building analysis and evaluation arguments on this question: "Evaluate the impact of the existence of a natural monopoly on consumer welfare"

Tuesday, 18 April 2017

All Themes: Labour markets - all you need to know

Unemployment and economic inactivity in the UK labour market are falling, but when we disaggregate the market we find that there remain persistent issues including risks of extreme poverty, labour immobility, skills shortages and the issues facing workers in vulnerable jobs perhaps facing a monopsony employer.

This short revision video looks at the problems in accurately measuring the marginal revenue product from employing an extra worker.

This short revision video looks at a numerical example of the difference between the average and marginal cost of employing extra workers when a business has to raise the average wage to expand their workforce.

Monopsony is a labour market structure in which there is a single powerful buyer of a particular type of labour. For example, the main buyer of the labour of doctors and nurses is the NHS or large employers such as Capita, G4S, Amazon and Sports Direct.

Trade Unions may use their collective bargaining power and bid for employers to pay a premium wage (or “wage mark-up”) above the normal competitive market wage. However, this might lead to an excess supply of labour and a contraction of total employment. This short revision video takes students through the basic analysis and some core evaluation arguments.

A trade union is an organised group of employees who work together to represent and protect the rights of workers, usually by using collective bargaining techniques.

This short revision video looks at the key roles of trade unions and the long term trend in union membership in the UK labour market.

Thursday, 13 April 2017

Theme 4: Economic growth & development in India

An excellent podcast on growth and development in India. A MUST read/listen for Year 13 students.

Wednesday, 12 April 2017

Theme 1: Positive externalities - breakfast & education

Definition of Positive Externality: This occurs when the consumption or production of a good causes a benefit to a third party. For example: When you consume education you get a private benefit. But there are also benefits to the rest of society.

A good example of positive externalities from a government initiative.....

A good example of positive externalities from a government initiative.....

Providing school breakfasts free to all children in disadvantaged English primary schools helps them to make two months’ additional progress in reading, writing and mathematics over the course of a year. This is the central finding of research by Christine Farquharson of the Institute for Fiscal Studies, presented at the Royal Economic Society's annual conference at the University of Bristol in April 2017.

In the study, the Education Endowment Foundation funded the charity Magic Breakfast so that 53 schools could establish breakfast clubs in 2014/15 at a total cost of £25 per eligible pupil. The Institute for Fiscal Studies analysed the results by comparing the schools offering breakfast clubs to similar schools, and finds that children aged 6 and 7 made an additional two months' progress in core subjects. Children aged 10 and 11 made similar gains in English.

These gains seem to be driven by fewer illness-related absences and by better behaviour and concentration in the classroom, meaning that even students who don’t eat breakfast at school can benefit from the improved learning environment.

The author comments: ‘The improvement in classroom behaviour and concentration in schools randomly selected for Magic Breakfast support is exceptional. In the policy-making world, the effect of Magic Breakfast provision is as close to magic as an intervention can get.’

Sunday, 9 April 2017

Tuesday, 21 March 2017

Thursday, 16 March 2017

All Themes - Great article by the late Hans Rosling - economic growth and development

Click here to access a great article by the late Hans Rosling. the Swedish professor who made global health statistics compelling viewing.

Click here to access a great article by the late Hans Rosling. the Swedish professor who made global health statistics compelling viewing.

Labels:

economic development,

economic growth,

hans rosling

Theme 2: Tutor2U assessment week mark scheme

Attached is the paper 2 mark scheme for the section A questions you completed.

Theme 4: Muhammad Yunus and Micro-financing - alternative economic development

Watch the first 5 or so minutes and ask yourdself the question, to what extent will this create economic development in sub Saharan Africa?

Labels:

economic development,

micro finance,

muhammad yunus

Monday, 13 March 2017

Theme 4: Globalisation & Inequality 2015

We will be looking at this presentation after we have gone through the exam papers. In the meantime, try and watch the video clip.

Saturday, 11 March 2017

GCSE Economics Paper

Please complete the paper below. It is a 2 hour IGCSE paper which covers exactly the same material that you will be tested on. It should take you at least the 2 lessons that I am going to miss (today and Monday).

We will work through this paper and the assessment papers you took over the 4 lessons we have left before the Spring Break.

It is essential that you take this activity seriously. Copy all answers into your exercise books. Thank you and see you on Tuesday.

We will work through this paper and the assessment papers you took over the 4 lessons we have left before the Spring Break.

It is essential that you take this activity seriously. Copy all answers into your exercise books. Thank you and see you on Tuesday.

Wednesday, 8 March 2017

Theme 1: Negative externalities and market failure

This is a short revision video revising how negative production externalities can cause market failure.

Theme 1: Price Elasticity of Supply

Here is a short revision video looking at the link between the amount of spare capacity in a business and the price elasticity of supply.

All Economists: The latest Economic Review - a must read

You all should take some time to read the latest 'Economic Review'. It is available in the library along with all recent back copies. The articles in there are all exam related and really useful for extra knowledge and application.

Monday, 6 March 2017

Theme 4: Poverty, the Lorenz curve and the Gini coefficient

The Lorenz Curve shows the degree of income inequality in a given economy or population. The further away the Lorenz curve from the line of absolute equality (the 45° line), the greater the degree of income inequality. Lorenz curves can also be used to illustrate wealth inequality.

This is a really interesting MC question on causes of a shift in a country's Lorenz Curve. A Gini coefficient of zero expresses perfect equality where all values are the same (for example, where everyone has an exactly equal income). A Gini coefficient of one (100 on the percentile scale) expresses maximal inequality among values (for example where only one person has all the income).

This is a really interesting MC question on causes of a shift in a country's Lorenz Curve. A Gini coefficient of zero expresses perfect equality where all values are the same (for example, where everyone has an exactly equal income). A Gini coefficient of one (100 on the percentile scale) expresses maximal inequality among values (for example where only one person has all the income).

Monday, 27 February 2017

Theme 4: Transfer Earnings & Economic Rent

Economic rent is any amount earned by a factor of production, such as labour, above the minimum amount they require to work in a current occupation

Transfer earnings are the minimum reward required to keep factors of production, such as labour, in its current occupation.

Labels:

economic rent,

labour market,

transfer earnings

Theme 3: The Principal - Agent problem

Here is a short video explaining the 'Principal-Agent problem

Theme 4 and paper 3: An exemplar essay on the Chinese Economy

Essay: The state of the Chinese economy – an overview

Between 2011 and 2013

China poured 6.6 gigatons of cement – more than the amount used by the USA

during the entire 20th century.

That single statistic encapsulates both the successes and failures of 21st Century China.

On the one hand you have

the unprecedented levels of supply side investment building up the capital

stock and fueling growth. Yet on the other hand you have the excess that has

lead to serious concerns.

One fundamental success

of the modern Chinese story has been growth. Since 2009 alone its economy has

more than doubled in size, and it has increased 11 times over since 1998 to

grow to $11.01 trillion in 2015. It is claiming an increasing share of world

output (as measured by GDP). Adjusted for purchasing power parity, China has

overtaken the USA to account for a 17.65% share, the worlds largest. The nation

has accounted for 1/3 of global growth this millennium.

China's centrality to the

global economy consequently gives it huge influence around the world; it has a

big voice in institutions like the UN (as a permanent member of the Security

Council) and the World Bank, and also has significant leverage when brokering

trade deals – access to Chinese markets and capital is increasingly attractive.

China is currently negotiating 9 different bi-lateral trade deals with

countries from the Maldives to Norway and existing deals with dozens of others.

This is one example of the positive multiplier effect of growth, as these trade

deals lay the foundations for further growth.

You can evaluate this by

saying that this growth has come at a cost – China has some of the worst

environmental problems in the world. According to the world bank 53 billion

tonnes of untreated industrial and household sewage make there way into China’s

waterways, 70% of which are affected. The situation has gotten so bad that

China will face water scarcity by 2030 unless serious interventions are

undertaken, with 300 million people already without access to safe water. Substances

from cadmium to arsenic have been found in river water. Although anti-pollution

laws exist, in many regions they are lightly enforced with businesses often

given significant leeway due to their economic importance.

In response China has

committed $625 billion to better managing the environment, but considering the

range of issues it faces this may not be enough. To water scarcity, you can

add; desertification, overgrazing, soil salinization, soil erosion a loss of

biodiversity and air pollution. Many of these challenges have arisen due to

increasingly intensified farming practices that are required to feed China’s

ever-growing population., particularly the middle classes that are now

demanding far more meat than the Chinese agricultural system was ever expected

to produce. As animal farming is far more land and water intensive than crop

farming, these problems are more likely to get worse than better.

Air pollution is a

particularly salient issue in China. It is home to 16 of the worlds 20 most

polluted cities and leads the world in smog-related respiratory and

cardio-vascular disease deaths. 25.5 million tonnes of acid rain falls every

year, thanks to the sulfur dioxide and black carbon that pours out of China’s

thousands of coal fired power stations (provide 70% of total power) and

steel/chemical plants.

More people own a car in

China than ever before and that has been the major contribution in the last two

decades, with exhaust emissions added to an already toxic mess. Beijing

suffered major public relations damage in the run-up to the 2008 Olympics over

concerns surrounding the Beijing smog, and air quality concerns could become a

road-block to further events of this magnitude. The contribution to global

warming is also of great concern, as is the burden of the pollution related

disease on the economy.

As the Chinese economy

ages, its workforce will become sicker and it does not need the extra burden of

workers missing days and needing hospital care.

It is also leveraging

this growth into broadening its soft power. It has the third most voting power

in both the World Bank and the IMF – evidence of the dividends of this is the

decision by the IMF to make the renminbi a part of the Special Drawing Rights

basket of currencies, a major step in the renminbi's rise to global reserve

currency status. Not satisfied with influencing existing institutions, China

has founded the Asian Infrastructure Investment Bank, which many have touted as

a rival to the World Bank. With the combined weight of 21 Asian nations behind

it and free from US or UN influence, the bank has attracted western support

from the likes of the UK and the USA.

The bank fits neatly into

the Chinese Governments biggest project 'The New Silk Road' which is designed

to increase trade with Eurasia and Africa. China has been investing billions in

East Africa over the last 20 years, with $26 billion spent in 2013 alone,

mostly in resource exploitation, but returns are limited by the poor capital

stock of the region. The same Is true across much of central Asia. China is

more familiar than any country of the power of supply side investment, so is

happy to lend money and expertise, safe in the knowledge that they would share

directly in the benefits of improved access and smoother supply chains, as well

as closer ties with grateful governments. Perhaps the best indicator of China's

soft power success was the USA's refusal to join the AAIB, perhaps out of

wariness of China's increasing sway.

Another, perhaps

under-appreciated success of modern China has been the major rise in living

standards. Relative to the USA, China was on a par with India in the early

1990s with just 5% of US GDP per capita (PPP). It is now overtaking Brazil, the

one-time darling of development economists, and is approaching the 30% mark, a

significant improvement in such as short space of time. Through large scale

urbanization and growth China has reduced the poverty rate (measured as living

on less than $1.25 a day) from 85% in 1981 to 27% in 2004, emancipating over

600 million people, with millions more escaping poverty since.

This increased wealth is

most apparent in the 300 million strong middle class that could double by 2021.

A larger middle class means that China has begun to rebalance its economy away

from the cheap unit labour cost exports of the past, into a powerful tertiary

sector founded upon domestic demand. The future of China looks less like

FoxConn and more like Baidu.

Whilst total poverty may

have fallen, relative income inequality has in fact worsened. A rising tide may

lift all boats, but is does not lift them equally. The One-Child policy

reinforced existing gender inequality, with men still having a significant advantage

over women through all stages of life. Rapid urbanization has also created a

growing gap between rural and urban populations, with government investment on

infrastructure and services focused on population centres. The differences

between Shanghai and an interior farming region are now extremely acute, which

in the long run could lead to social and political tension. China’s Gini

coefficient has risen far and fast, from 0.3 in the 1980s to 0.53 2013. The

continued health of the one party system could be called into question if

growth falters and the middle and working classes see their living standards

stop rising.

Finally, China in recent

years has made big progress in diversifying its economy as it matured. The

image of China as low quality manufacturing hub filled with sweatshops is now

woefully outdated. Thanks to the agglomeration effects of the Special Economic

Zones first created in the 80's, China has become a centre of innovation and

economic complexity. It is at the forefront of mobile technology, with brands

like Huawei and China Mobile recognised the world over. These corporations have

huge international presence with Huawei alone investing $1.5 Billion in Africa

over the last 20 years.

By becoming a more

multi-faceted economy that was less dependent of exporting cheap manufactured

goods to the West, China is better placed to absorb exogenous shocks. It was

notable that China did not suffer as badly as many other major economies during

the 2008 financial crisis (admittedly in part due to a strong fiscal stimulus

plan).

While private companies

may be thriving in the new China, state-owned enterprises are not doing as

well. Like many SOEs, they struggle with x-inefficiency and without a profit

motive they do not contribute to the innovation that would provide China with a

competitive advantage in global trade. This is arguably seen in the well-earned

reputation of SOE’s for having no respect for foreign intellectual property

laws, as the SOE’s cannot develop their own ideas. Consequently, they hold back

the economy, cornering parts of the economy the private sector could take

further, as well as capturing the skilled workers in secure, well payed

government jobs when their talents would be better exercised in a more

competitive environment. It is also true that returns to investment are falling

in China as the economy becomes steadily more leveraged. Areas of rapid growth

are becoming fewer and further between (hence the expansion into East Africa)

and household debt to GDP has more than doubled in ten years. The shock of the

Shanghai stock crash of 2015 has lead to growing fears that Chinese economy is

more fragile than previously thought. Its latest boom certainly bears the

hallmarks of a crash waiting to happen; a large housing bubble and an overleveraged

population.

In the short run, China

appears to be a great success; combining rapid growth with poverty reduction,

political stability and increased global standing. Yet in the long run its

challenges are at risk of overwhelming it. The burden of an ageing, unbalanced

population, the risk of the middle income trap, environmental issues and an

over-leveraged economy is a potent cocktail of problems that threatens the

long-term economic success and political stability.

Johnny Wallace

Subscribe to:

Comments (Atom)