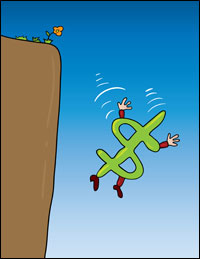

Several analysts are predicting a tough 12 months ahead for the US dollar.

The US economic recovery is stalling with little impact of strong growth. Unemployment figures have been depressing and look unlikely to fall in the near future.

Given prospect for weak growth, deflation, high unemployment and lack of fiscal stimulus, the Federal Reserve has indicated that they will resume the policy of quantitative easing to try and increase demand in the economy. Ben Bernanke, the Fed chairman said the bank was "prepared to provide additional accommodation if needed to support the economic recovery and to return inflation over time to levels consistent with our mandate."

Weakness of the Dollar Results from:

Low Interest Rates with no prospect of rising rates.

Weak prospect for growth and unemployment.

Prospect for further Quantitative easing.

High Levels of public sector debt. A concern is that growing levels of public debt will undermine the confidence in the dollar. Europe and the UK under the Conservatives have been more willing to pursue spending cuts and austerity measures.

If the US economy was to bounce back and grow strongly, the prospects for the dollar would immediately change as it would raise possibility of higher interest rates and end to quantitative easing.

However, it is hard to see this bounce in the US economy.

The financial sector is still stretched from the ongoing effects of mortgage defaults and the credit crunch.

Government shows little appetite for a fiscal stimulus package. If anything, spending cuts are more likely.

Rising joblessness is reducing confidence and spending.

Goldman Sachs, the investment bank expects the dollar to drop to $1.79 against the pound in six months and $1.85 in 12 months. Against the Euro, Goldman Sachs expect it to fall to $1.50 in six months and $1.55 in a year’s time.

A sore point for the US economy is also the perceived undervaluation of the Chinese Yuan. The Chinese have been keeping their currency undervalued by intervening in the market to buy dollars. If China reversed this policy and stopped keeping the Yuan weak, the dollar would depreciate further against the Chinese currency, though there is little evidence of this change in policy.

No comments:

Post a Comment