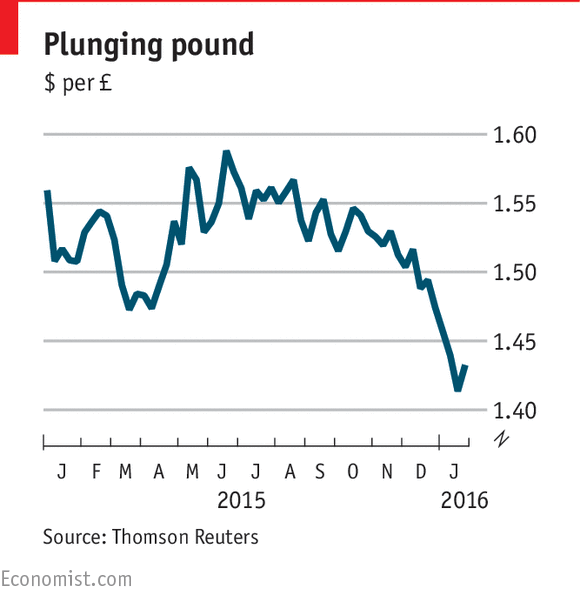

According to The Economist, Sterling has had a very choppy history, marked by crises such as 1967, 1976 and 1992. And it is having another rocky period. Thanks to Guy Tennant at Norwich School for highlighting this article:

In trade weighted terms, the £ Sterling has dropped more than 7% in just two

months, a fall of a magnitude only surpassed once since the MPC assumed

responsibility for setting UK monetary policy in 1997. The pound has behaved more

like a commodity currency (the Aussie or Canadian dollars) even though it is a large

net importer of commodities.

months, a fall of a magnitude only surpassed once since the MPC assumed

responsibility for setting UK monetary policy in 1997. The pound has behaved more

like a commodity currency (the Aussie or Canadian dollars) even though it is a large

net importer of commodities.

Mark Carney, the governor of the Bank of England, indicated recently that British interest rates were unlikely to rise in the near future. That may have held down Sterling. But interest rate expectations can't explain these moves.

Are fears of BREXIT responsible?

Recently there’s been a big increase in the focus on the UK's EU referendum – with

some insiders believing that the likelihood that Britain votes to exit the EU has risen

from 30% to 35%. The uncertain outcome has led to a weaker sterling, which reflects reduced demand and increased risk for UK assets. “But current sterling weakness

is probably only a small taste of what would be store for the UK in the unlikely event

of an exit”.

some insiders believing that the likelihood that Britain votes to exit the EU has risen

from 30% to 35%. The uncertain outcome has led to a weaker sterling, which reflects reduced demand and increased risk for UK assets. “But current sterling weakness

is probably only a small taste of what would be store for the UK in the unlikely event

of an exit”.

The Economist is against BREXIT, and quotes bank ING, who think the uncertainty of

the vote might lead to a quarter of a point being knocked off this year's GDP growth,

and a further 1.2 points off 2017 GDP if Britain votes to leave. Morgan Stanley's economists write that “We expect the outcome to be a close call. We also think that

a vote to leave the EU would trigger a major and sustained rise in political and economic uncertainty”.

the vote might lead to a quarter of a point being knocked off this year's GDP growth,

and a further 1.2 points off 2017 GDP if Britain votes to leave. Morgan Stanley's economists write that “We expect the outcome to be a close call. We also think that

a vote to leave the EU would trigger a major and sustained rise in political and economic uncertainty”.

Indeed, Brexit could trigger another Scottish referendum to leave the UK. This

uncertainty would make it less likely that both domestic and foreign companies

would invest in Britain and according to another bank: “if the UK voted to leave, the

risk of an immediate and severe weakening in economic activity would be very high

and we would not rule out a recession. Consumer and business sentiment could

decline sharply, leading to a slowdown in consumption and business investment".

uncertainty would make it less likely that both domestic and foreign companies

would invest in Britain and according to another bank: “if the UK voted to leave, the

risk of an immediate and severe weakening in economic activity would be very high

and we would not rule out a recession. Consumer and business sentiment could

decline sharply, leading to a slowdown in consumption and business investment".

Those in favour of BREXIT will dispute the numbers, arguing that Britain will be

better off without the dead hand of EU regulation, contributions into the EU Budget

and so on. Given all the uncertainties (Norway is outside the EU but has to

contribute to the budget, for example), there can be no definitive answer. Fans of behavioural economics might note that minds on either side are unlikely to

be swayed by these numbers; confirmation bias tends to set in (you only believe

"facts" that chime with your initial opinion).

better off without the dead hand of EU regulation, contributions into the EU Budget

and so on. Given all the uncertainties (Norway is outside the EU but has to

contribute to the budget, for example), there can be no definitive answer. Fans of behavioural economics might note that minds on either side are unlikely to

be swayed by these numbers; confirmation bias tends to set in (you only believe

"facts" that chime with your initial opinion).

Axa, the French insurance company, has just come up with a cost of Brexit of

2-7% of GDP, largely down to the effects of reduced investment and consumer

uncertainty. In the long run, the British economy would probably adjust to the

new reality. Open Europe, a think tank, estimated that the shift in UK GDP by

2030 would lie somewhere in the range of minus 1.6% to plus 2.2%.

2-7% of GDP, largely down to the effects of reduced investment and consumer

uncertainty. In the long run, the British economy would probably adjust to the

new reality. Open Europe, a think tank, estimated that the shift in UK GDP by

2030 would lie somewhere in the range of minus 1.6% to plus 2.2%.

Of course, one likely reason for depreciation is Britain's current account deficit,

which at 4.5% of GDP, needs foreign capital to finance it. In the absence of

foreign direct investment, that deficit would be harder to finance; hence sterling's

fall.

A fall in the pound could help exporters but that tactic hasn't been working

elsewhere

(nor did it for the UK when the pound last plunged in 2008-09).

which at 4.5% of GDP, needs foreign capital to finance it. In the absence of

foreign direct investment, that deficit would be harder to finance; hence sterling's

fall.

A fall in the pound could help exporters but that tactic hasn't been working

elsewhere

(nor did it for the UK when the pound last plunged in 2008-09).

No comments:

Post a Comment